Axis Bank Home Loan Interest Rates range from 675 - 720 per annum. Request the bank in writing to switch your home loan from the base rate scheme to MCLR After the loan is linked request the banker to reduce the quantum of your interest. Axis bank home loan interest rate change.

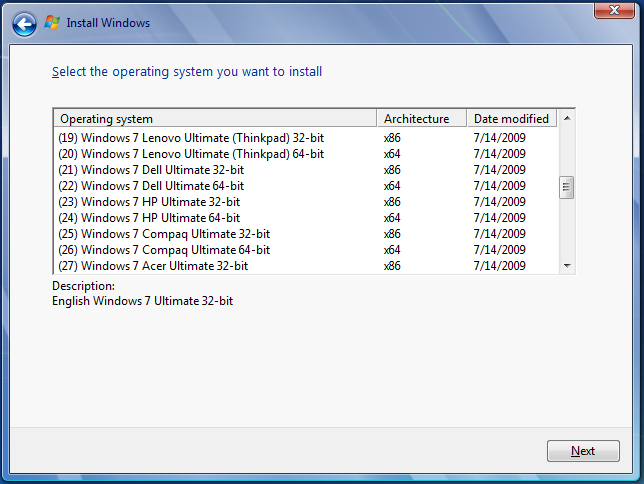

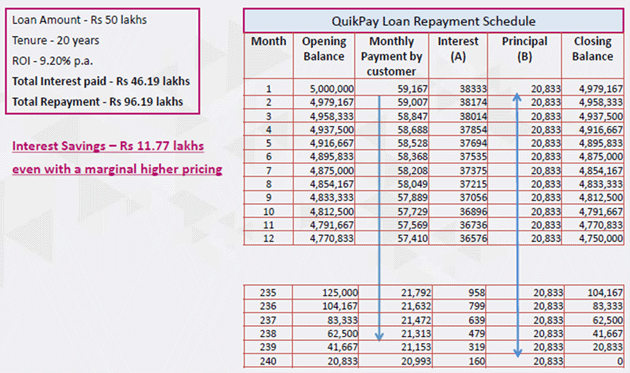

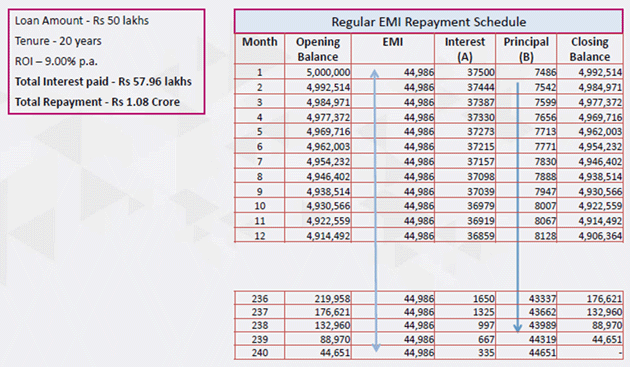

Axis Bank Home Loan Interest Rate Change, MCLR rates are reset once every six months. EMI 5100000 00083 1 00083180 Rs 54805 1 00083180 -1. Say you opt for a typical or regular home loan to the tune of Rs 50 lakh 900 pa. Axis Bank Axis Bank Home Loan Fulfill your dream of owning a home with Axis Bank that offers home loans with smaller EMIs attractive rates.

Looking For Best Deals On Home Loan Check Out Cheapest Rates Festive Offers Businesstoday From businesstoday.in

Looking For Best Deals On Home Loan Check Out Cheapest Rates Festive Offers Businesstoday From businesstoday.in

Fixed-rate loans are not based on MCLR rates. For loans up to Rs 28 lakhs interest will be applicable at the rate of BR 095 which is 145. Floating Rate Repo Rate 630 to Repo Rate 750 1030 - 1150 pa. Earlier as a part of festive offers the Bank of India had announced a 35 basis point reduction in its home loan interest rates and a 50 basis points in vehicle loan interest rates.

Repo Rate change on the reset date for loans sanctioned from 1st October19.

Read another article:

Say you opt for a typical or regular home loan to the tune of Rs 50 lakh 900 pa. Axis Banks Base Rate BR for loans sanctioned from 1st July 2010. For 20 years tenure. Axis Bank lowered its balance transfer rates on home loans to 670 per cent. Marginal Cost based lending rate is 730.

Source: axisbank.com

Source: axisbank.com

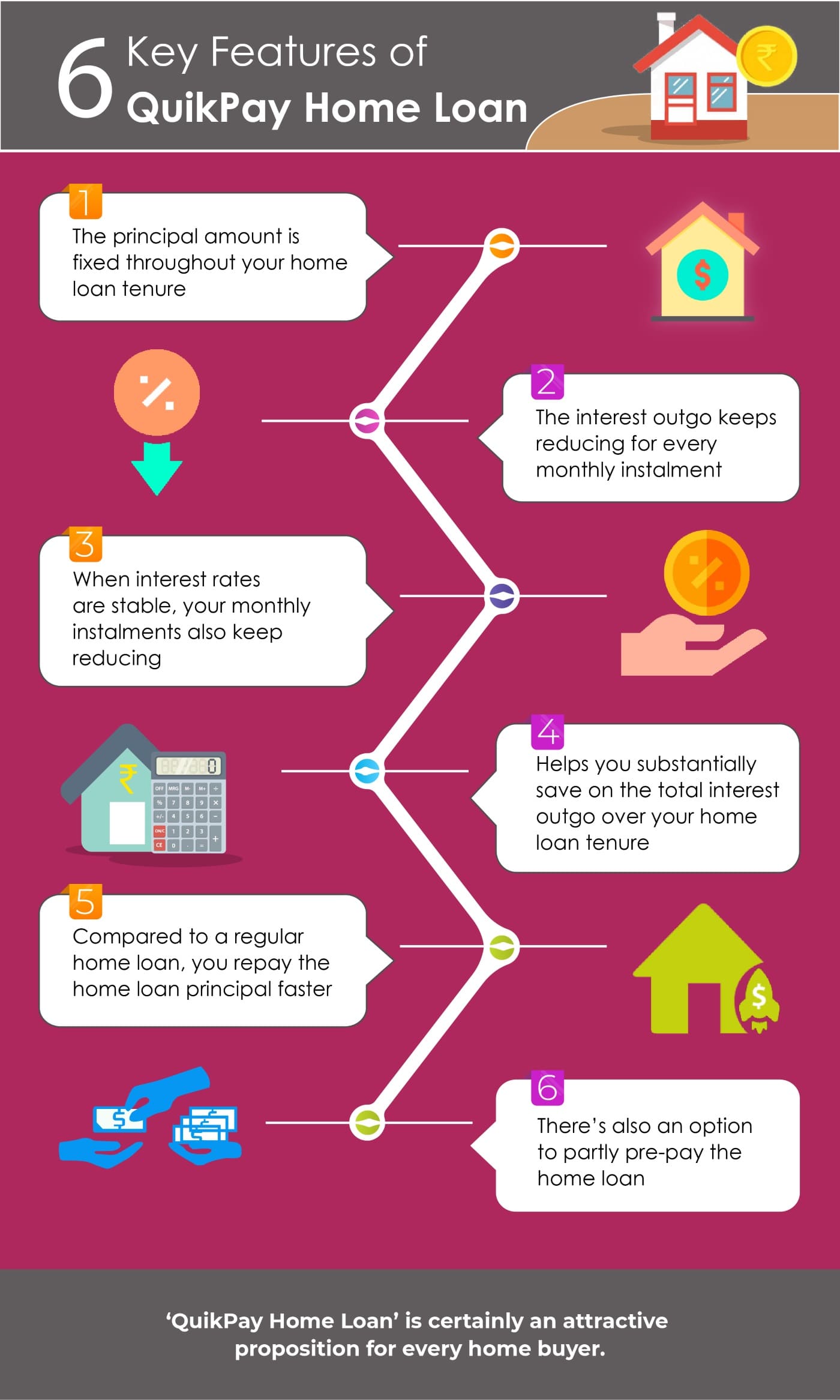

Axis Bank home loan available at interest rates of 690. Click on 3 bar menu Services Support Credit Cards. How much will you save by opting for a QuikPay Home Loan. For Loans on Marginal Cost based Lending Rate. Home Loan Balance Transfer All You Need To Know.

Source: bankbazaar.com

Source: bankbazaar.com

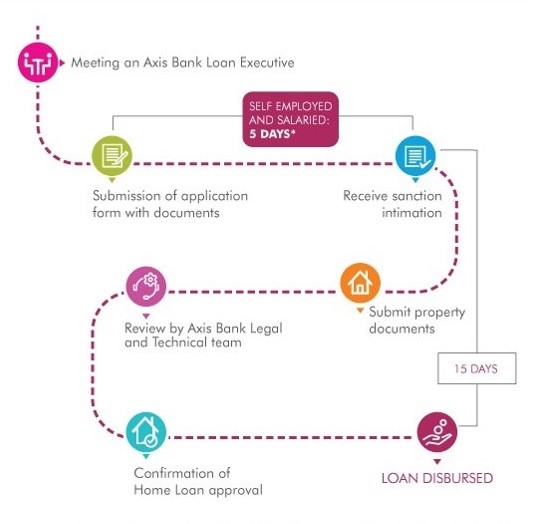

And the tenure of the loan is 15 years your EMI will be calculated as under assuming a 1 processing fee. Repo Rate change on the reset date for loans sanctioned from 1st October19. Minimum of Rs3 lakh. For example if you borrow Rs 5100000 for a home loan from Axis Bank at a rate of interest of 10 pa. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: businesstoday.in

Source: businesstoday.in

For Loans on Marginal Cost based Lending Rate. This may include a one-time fee but the rate of interest payable by you will reduce henceforth. Axis Bank Home Loan Processing Fees. The Home Loan floating rate will change when either of below rate changes. Save Lakhs On Home Loan Here S What You Need To Do Businesstoday.

Source: m.economictimes.com

Source: m.economictimes.com

The Home Loan floating rate will change when either of below rate changes. For Loans on Base rateMRRBPLR. The interest rates will be reset every 6 months based on change in this rate. Set Reset PIN Send OTP Enter OTP Enter New PIN Confirm New PIN Click Set PIN Enter mPIN PIN will be changed. Axis Bank S New Home Loan Offering Can Help Bring Down Interest Cost Here S How The Economic Times.

Source: bankbazaar.com

Source: bankbazaar.com

Maximum of 30 years. Self-employed NRIs can avail this home loan on a floating interest rate plan. Top-Up Loan by Axis Bank is an additional finance facility for Home Loan Customers against the mortgage of their existing property. Repo Rate change on the reset date for loans sanctioned from 1st October19. How To Get Axis Bank Personal Loan Account Statement.

Source: axisbank.com

Source: axisbank.com

Axis Bank home loan available at interest rates of 690. You can choose between floating or a fixed rate of interest. For Loans on Base rateMRRBPLR. Borrowers will check Documents Eligibility EMI per lakh Repayment options loan amount prepayment charges online at Deal4loans. Axis Bank Home Loan Frequently Asked Questions.

Source: axisbank.com

Source: axisbank.com

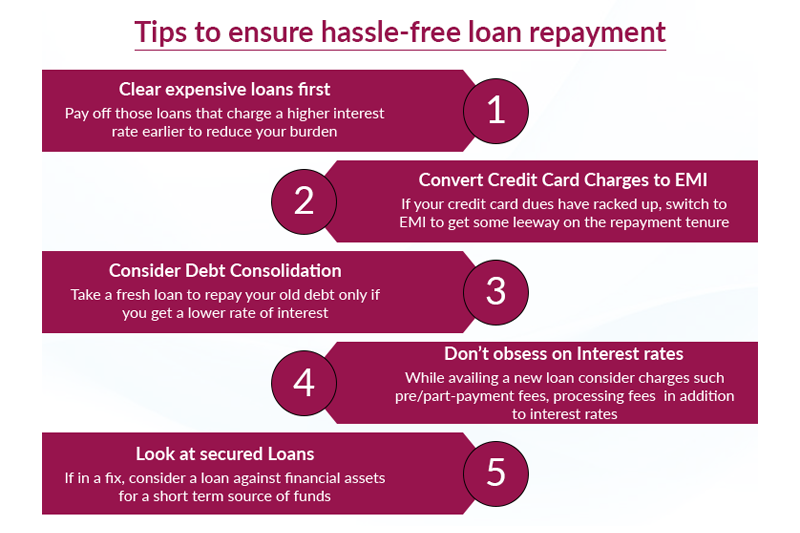

Axis Bank Home Loan Interest Rate October 2021 Zero PF Offer for balance transfer for Plot Purchase Construction New Housing Loan Axis Bank home loan agents in Gurgaon Mumbai ahmedabad Bangalore Hyderabad Lucknow Delhi Noida are ready to help you. The Base Rate BR applicable on the floating interest rate plan is fixed at 950. Axis Bank Home Loan Processing Fees. Click here to know more about its. Five Tips To Follow When Planning Loan Repayment.

Source: m.economictimes.com

Source: m.economictimes.com

Say you opt for a typical or regular home loan to the tune of Rs 50 lakh 900 pa. Earlier as a part of festive offers the Bank of India had announced a 35 basis point reduction in its home loan interest rates and a 50 basis points in vehicle loan interest rates. Say you opt for a typical or regular home loan to the tune of Rs 50 lakh 900 pa. Click on 3 bar menu Services Support Credit Cards. Axis Bank S New Home Loan Offering Can Help Bring Down Interest Cost Here S How The Economic Times.

Source: bankbazaar.com

Source: bankbazaar.com

Axis Bank lowered its balance transfer rates on home loans to 670 per cent. The Home Loan floating rate will change when either of below rate changes. Axis Bank lowered its balance transfer rates on home loans to 670 per cent. This is because the Reserve Bank of India RBI has asked all scheduled commercial banks except regional rural banks local area banks and small finance banks to link interest rates on retail and MSME loans to an external benchmark rate with effect from October 1 2019. Axis Bank Home Loan Status Steps To Check Application Status Online.

Follow the below path to update your Credit Card PIN. The interest rate for the customer shall depend on their credit assessment and the product variant AXIS BANK. Axis Banks Marginal cost of lending rate MCLR change on the reset date for loans sanctioned from 1st April 2016. The interest rates will be reset every 6 months based on change in this rate. Facebook.

Source: businesstoday.in

Source: businesstoday.in

For floating-rate home loans Axis Bank takes the 6-month MCLR as benchmark and adds a premium or mark-up to the MCLR to arrive at the actual lending rate. Request the bank in writing to switch your home loan from the base rate scheme to MCLR After the loan is linked request the banker to reduce the quantum of your interest. Fixed-rate loans are not based on MCLR rates. This is because the Reserve Bank of India RBI has asked all scheduled commercial banks except regional rural banks local area banks and small finance banks to link interest rates on retail and MSME loans to an external benchmark rate with effect from October 1 2019. Looking For Best Deals On Home Loan Check Out Cheapest Rates Festive Offers Businesstoday.

Source: axisbank.com

Source: axisbank.com

EMI 5100000 00083 1 00083180 Rs 54805 1 00083180 -1. Borrowers will check Documents Eligibility EMI per lakh Repayment options loan amount prepayment charges online at Deal4loans. Tenure Upto 30 years Processing fee Rs 10000GST Loan amount Rs3 lakh - Rs5 crore Prepayment Charges Nil. With the change in interest rate your Monthly Instalments will increase or decrease while the loan tenure will remain constant. Quikpay Home Loan Reduce The Interest Outgo Of Your Home Loan.

Source: fortuneindia.com

Source: fortuneindia.com

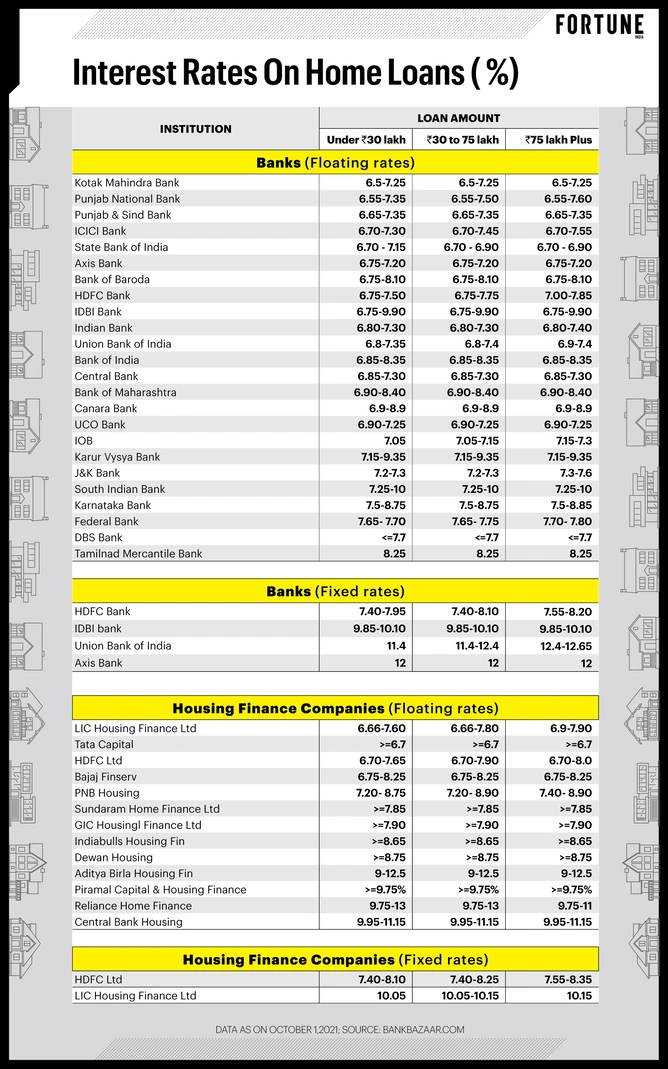

Axis Bank Home Loan Interest Rates range from 675 - 720 per annum. Self-employed NRIs can avail this home loan on a floating interest rate plan. The interest rate is the most important thing that an individual looks for in a home loan facility. Lower interest rates help you in decreasing the. Home Loan Interest Rates Fall Should You Refinance.

Source: bankbazaar.com

Source: bankbazaar.com

Follow the below path to update your Credit Card PIN. A Personal Loan from Axis Bank ensures that you can meet all your goals with ease. Axis Bank home loan interest rates are among the lowest rates in December 2021 available. Axis Banks Base Rate BR for loans sanctioned from 1st July 2010. Axis Bank Home Loan Status Steps To Check Application Status Online.

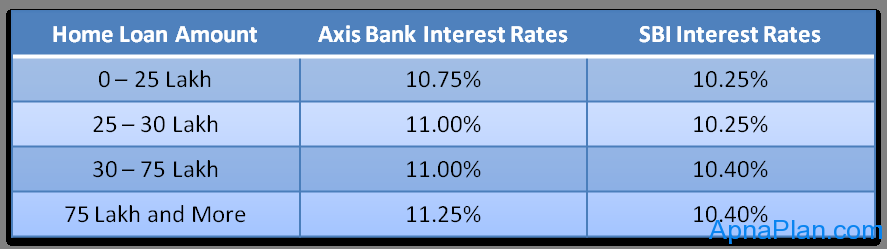

Source: apnaplan.com

Source: apnaplan.com

The interest rates will be reset every 6 months based on change in this rate. Axis Bank home loan interest rates are among the lowest rates in December 2021 available. Tenure Upto 30 years Processing fee Rs 10000GST Loan amount Rs3 lakh - Rs5 crore Prepayment Charges Nil. Axis Bank Home Loan Interest Rate October 2021 Zero PF Offer for balance transfer for Plot Purchase Construction New Housing Loan Axis Bank home loan agents in Gurgaon Mumbai ahmedabad Bangalore Hyderabad Lucknow Delhi Noida are ready to help you. Axis Bank Happy Ending Home Loan Review.