6 months at this rate. 565 Apr-2016. Average home loan interest rate australia.

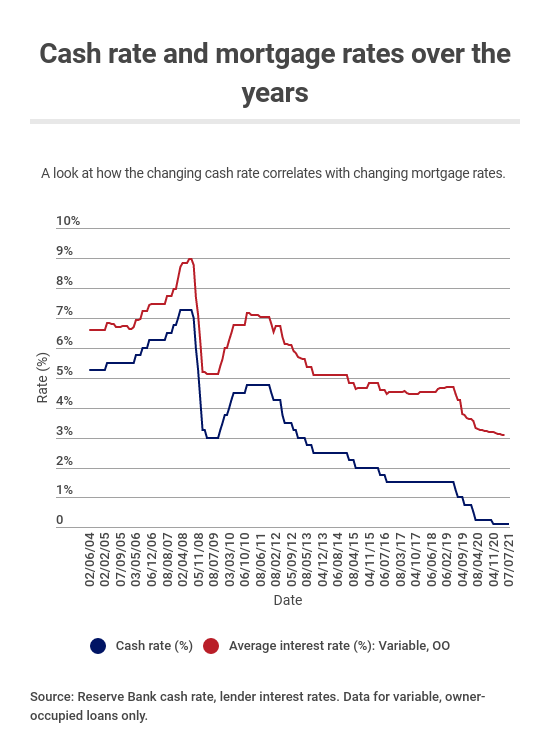

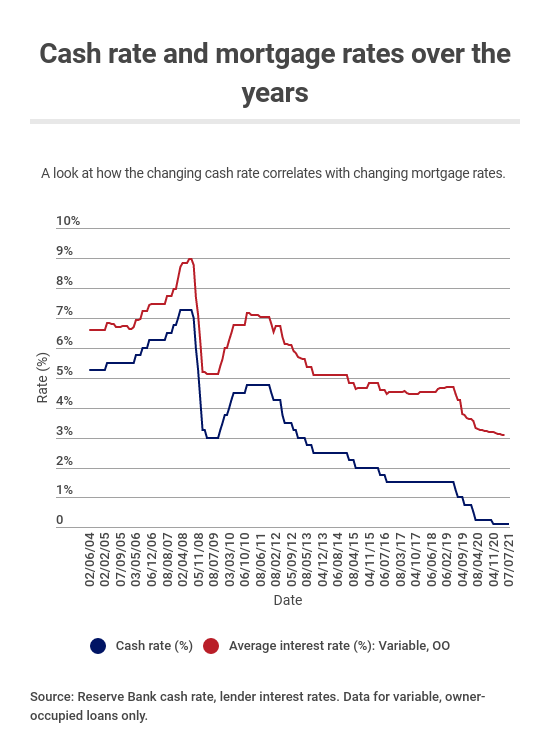

Average Home Loan Interest Rate Australia, In March 2018 the official interest rate was just 15 and the average advertised standard variable rate was 525. Start your home loan comparison at RateCity and compare home loan interest rates today. Amid intense competition among lenders the market leading variable home loan rates fell to under three per cent. Low rates are enticing investors and new homeowners the like but many experts are predicting an inevitable rate rise.

Banks Warned To Be Prepared For Negative Interest Rates But Will That Ever Happen Compare The Market From comparethemarket.com.au

Banks Warned To Be Prepared For Negative Interest Rates But Will That Ever Happen Compare The Market From comparethemarket.com.au

540 Jul-2016. Currently the average 4-year fixed rate in our database sits at 292 pa. Taking this into account servicing the average loan over 25 years at the average standard variable rate in March 2008 would have cost 2113 a month. In 2019 the Reserve Bank cut the cash rate to its lowest ever recorded point 10 per cent in July.

Taking this into account servicing the average loan over 25 years at the average standard variable rate in March 2008 would have cost 2113 a month.

Read another article:

3 months at this rate. In March 2018 the official interest rate was just 15 and the average advertised standard variable rate was 525. In most cases the annual fees range from 350-395 which gets you a range of loan features and entitles you to the additional discount which in most cases ranges between 09 and 165. Taking this into account servicing the average loan over 25 years at the average standard variable rate in March 2008 would have cost 2113 a month. Between July 1991 and March 2008 the average annual real increase in the average first home buyer housing loan commitment by significant lenders ranged from 40 in South Australia to 55 in Queensland and Western Australia.

Source: focus-economics.com

Source: focus-economics.com

Our latest variable and fixed rates for new customers who are looking for owner occupier or. The average variable interest rate on the RateCity database was found to have fallen to 463 at the end of April 2018 down from 464 at the end of March 2018. Compare home loan rates from 159. 565 Apr-2015. Australia Interest Rate Australia Economy Forecast Outlook.

Source: rba.gov.au

Source: rba.gov.au

Currently the average 4-year fixed rate in our database sits at 292 pa. 13 rows New loans per annum. Start your home loan comparison at RateCity and compare home loan interest rates today. 3 months at this rate. The Distribution Of Mortgage Rates Bulletin March Quarter 2018 Rba.

Source: rba.gov.au

Source: rba.gov.au

Amid intense competition among lenders the market leading variable home loan rates fell to under three per cent. Accurate as at latest page published date. REAL CHANGE IN THE SIZE OF AN AVERAGE HOUSING LOAN a TO A FIRST HOME BUYER. As of June the average fixed 3-year rate was 293 with variable rates at 393. The Distribution Of Mortgage Rates Bulletin March Quarter 2018 Rba.

Source: mortgagechoice.com.au

Source: mortgagechoice.com.au

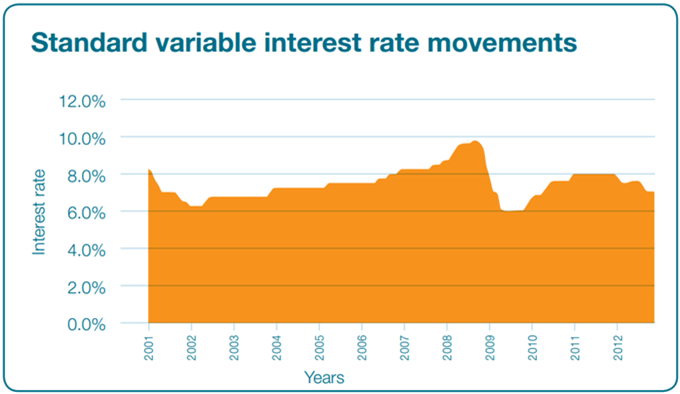

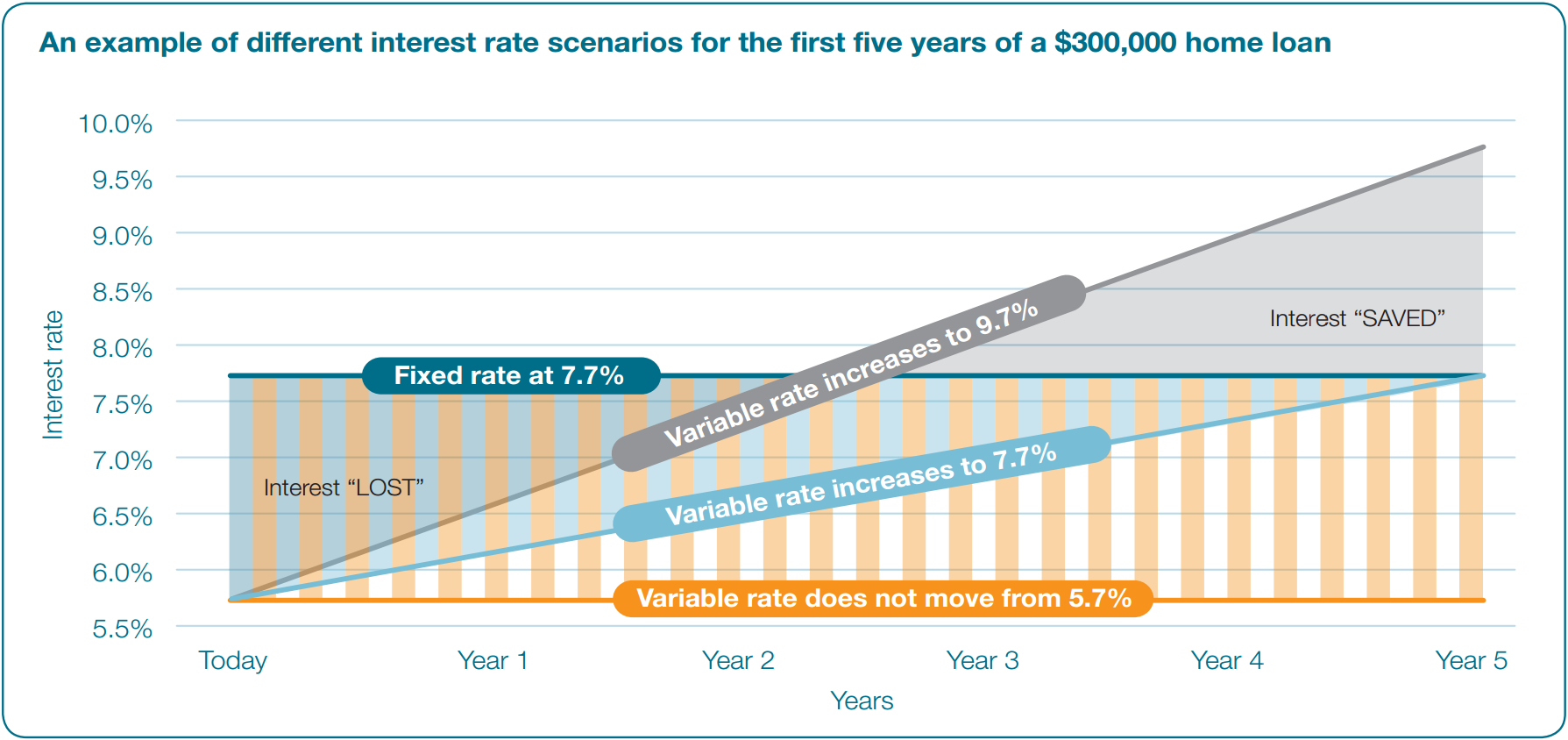

6 months at this rate. 194 198 comparison rate variable rate. It has remained at this rate since March 2020 with the RBA indicating it is unlikely to lift it until annual inflation is within the 2-3 target range. The variable rates above will typically be circa 10-150. Fixed Vs Variable Home Loans 2021 Mortgage Choice.

Source: yourinvestmentpropertymag.com.au

Source: yourinvestmentpropertymag.com.au

545 Oct-2015. Compare home loan rates from 159. Making now an ideal time to shop around and compare home loan rates from over 25 lenders. Amid intense competition among lenders the market leading variable home loan rates fell to under three per cent. Do Rising Interest Rates Cause Property Prices To Fall Your Investment Property.

Source: rba.gov.au

Source: rba.gov.au

3 months at this rate. In most cases the annual fees range from 350-395 which gets you a range of loan features and entitles you to the additional discount which in most cases ranges between 09 and 165. Australias home loan marketplace may be becoming slightly more affordable with average mortgage interest rates and fees falling across RateCity over the month of April. Our latest variable and fixed rates for new customers who are looking for owner occupier or. Household And Business Finances Financial Stability Review April 2019 Rba.

Source: infochoice.com.au

Source: infochoice.com.au

Apply for the Macquarie Bank Basic Home Loan - LVR 60 Owner Occupier PI and get a low variable interest rate plus no application and ongoing fees. The average new loan in Australia for people buying an existing property was 590026 in September 2021 up 16 on the month before. The average figure for a loan for buying a newly built home was 550647 down 03 on the previous month and 499401 for a loan to build a new home up 33. The final rate will depend on the amount you are borrowing. History Of Interest Rates In Australia Infochoice.

194 198 comparison rate variable rate. Average housing loan interest rate in Australia 2019-2020 by type of mortgage Published by Statista Research Department Feb 25 2021 As of the month ended December 2020 the average mortgage. The average variable interest rate on the RateCity database was found to have fallen to 463 at the end of April 2018 down from 464 at the end of March 2018. Best 5 Year Fixed Interest Rate for Non-Residents. Insights From The New Economic And Financial Statistics Collection Bulletin September Quarter 2020 Rba.

Source: aph.gov.au

Source: aph.gov.au

As of June the average fixed 3-year rate was 293 with variable rates at 393. Housing Loans Banks Standard Variable. Interest rates are at record lows but may not stay that way forever. Currently the average 4-year fixed rate in our database sits at 292 pa. Home Loan Interest Rates And Repayments Parliament Of Australia.

Source: infochoice.com.au

Source: infochoice.com.au

540 Jul-2016. In March 2018 the official interest rate was just 15 and the average advertised standard variable rate was 525. Taking this into account servicing the average loan over 25 years at the average standard variable rate in March 2008 would have cost 2113 a month. The cash rate is Australias official interest rate which is currently held at a target of 010 by the Reserve Bank of Australia RBA. History Of Interest Rates In Australia Infochoice.

Source: infochoice.com.au

Source: infochoice.com.au

545 Oct-2015. 6 months at this rate. Take a look at the rates and find the best one for you when youre ready you can contact us and well manage your home loan application for you from start to finish. 3 months at this rate. History Of Interest Rates In Australia Infochoice.

6 months at this rate. 13 rows New loans per annum. Currently the average 4-year fixed rate in our database sits at 292 pa. Bank Australia interest rates and fees. Insights From The New Economic And Financial Statistics Collection Bulletin September Quarter 2020 Rba.

Source: rba.gov.au

Source: rba.gov.au

This is the average of the standard variable interest rate of mortgages from Australias four major banks. Standard variable home loan rates reached 779 per cent pa in January 2011 according to the RBA but have been on a slide ever since. 3 months at this rate. Apply for the Macquarie Bank Basic Home Loan - LVR 60 Owner Occupier PI and get a low variable interest rate plus no application and ongoing fees. The Distribution Of Mortgage Rates Bulletin March Quarter 2018 Rba.

Source: comparethemarket.com.au

Source: comparethemarket.com.au

Bank Australia interest rates and fees. The average variable interest rate on the RateCity database was found to have fallen to 463 at the end of April 2018 down from 464 at the end of March 2018. Up from 237 in March while the average 5-year rate is slightly higher at. Making now an ideal time to shop around and compare home loan rates from over 25 lenders. Banks Warned To Be Prepared For Negative Interest Rates But Will That Ever Happen Compare The Market.

Source: mortgagechoice.com.au

Source: mortgagechoice.com.au

As of June the average fixed 3-year rate was 293 with variable rates at 393. Housing Loans Banks Standard Variable. Compare home loan rates from a wide range of Australian lenders and find mortgage offers that suit your needs. 6 months at this rate. Fixed Vs Variable Home Loans 2021 Mortgage Choice.