Homeowners Insurance in Canada. Posted on April 4 2018. Average home insurance cost bc 2018.

Average Home Insurance Cost Bc 2018, The national average cost of homeowners insurance was 1249 in 2018 according to the latest data from the Insurance Information Institute. The home insurance cost in British Columbia is considered most expensive ranging around 920 per year. The average home insurance rate is about 2305 per year. An average Canadian may pay around 850 per year for their home insurance.

How Home Insurance Rates In Canada Are Trending From canadianunderwriter.ca

How Home Insurance Rates In Canada Are Trending From canadianunderwriter.ca

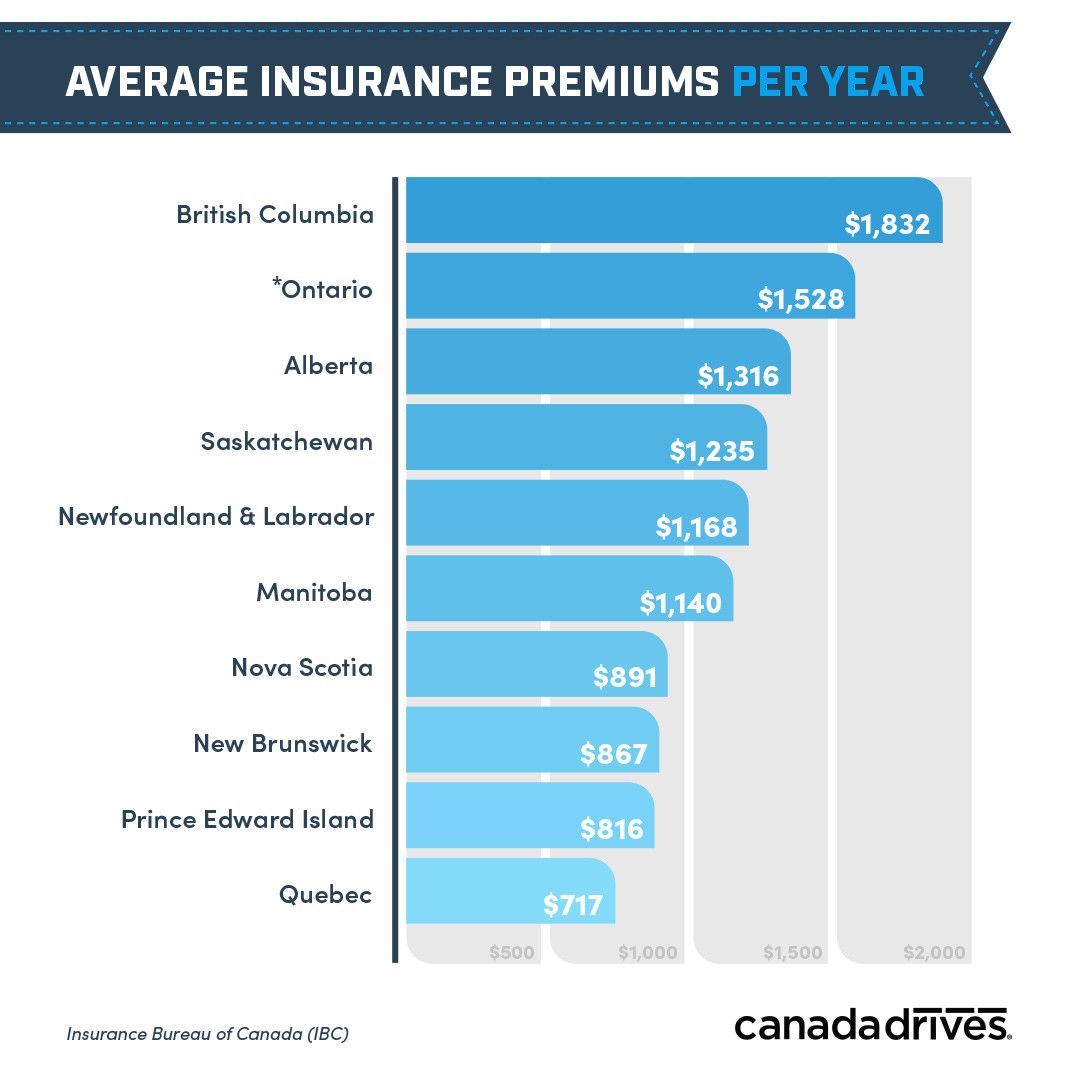

Canadians pay an average of 840 annually for their home insurance with prices strongly varying across provinces according to research by InsurEye Inc. This is 38 higher than the year before. Power the average policyholder in Quebec pays 960 a year. According to a new report from the Insurance Bureau of Canada IBC British Columbia drivers pay 1832 on average for their insurance coverage annually.

The average price of combined buildings and contents insurance stands at 13875 having decreased each quarter since Q3 2020.

Read another article:

The highest level of home insurance. The average price of combined buildings and contents insurance stands at 13875 having decreased each quarter since Q3 2020. If you have the cheapest home valued under 100K though that is not easy to find any more your average home insurance costs start at 45month. Is your homeowners insurance included in your mortgage payment. Own a home in BC.

Source: pinterest.com

Source: pinterest.com

How much is home insurance in BC. Homeowners Insurance in Canada. Power the average policyholder in Quebec pays 960 a year. The average cost of home insurance in the UK is 163 based on data published from the second quarter of 2018 by the AAs British insurance premium index. 33 Best Smart Home Automation Tips And Tricks Best Smart Home Smart Home Automation Home Automation System.

The average price of combined buildings and contents insurance stands at 13875 having decreased each quarter since Q3 2020. But Quebec residents only pay an average of 717 a 1115 price difference. And in the Atlantic and Ontario regions homeowners pay 1284. To see if you could be paying less why not spend 5 minutes and get a free quote. Toyota Car Insurance How Much Does It Cost Valuepenguin.

Meanwhile the average cost of Canadian house insurance is roughly 850. BC homeowners pay an average of 924 per year or about 80 per month depending on many factors. Get your quote today. The national average cost of homeowners insurance was 1249 in 2018 according to the latest data from the Insurance Information Institute. How Much Does Lamborghini Insurance Cost Valuepenguin.

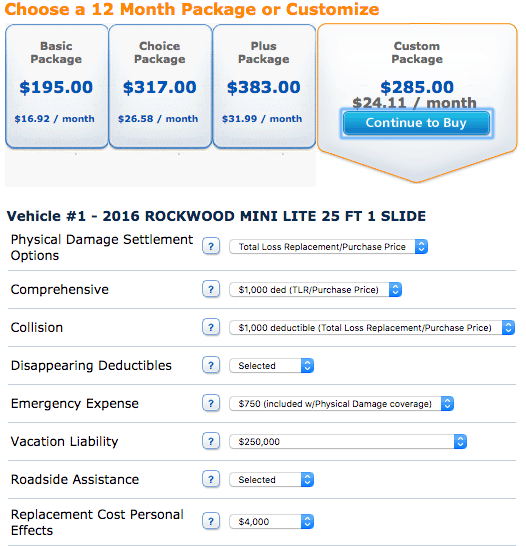

Source: camperreport.com

Source: camperreport.com

There are many factors that influence the cost of home insurance but you can take steps to lower your rates. The average annual car insurance premium in British Columbia is 1680 nearly 14 higher than the next name on the list Ontario 1445. Posted on April 4 2018. This is closely followed by home insurance costs in Alberta at around 900 per year. How Much Does Travel Trailer Insurance Cost Camper Report.

Source: insureye.com

Source: insureye.com

More expensive homes valued at 300K-700K and 700K-15M would come with a home insurance tag of 77 and 117 per month respectively. There are many factors that influence the cost of home insurance but you can take steps to lower your rates. The average cost of renters insurance was 179. Meanwhile the average cost of Canadian house insurance is roughly 850. Home Insurance Alberta Rates Quotes Consumer Tips.

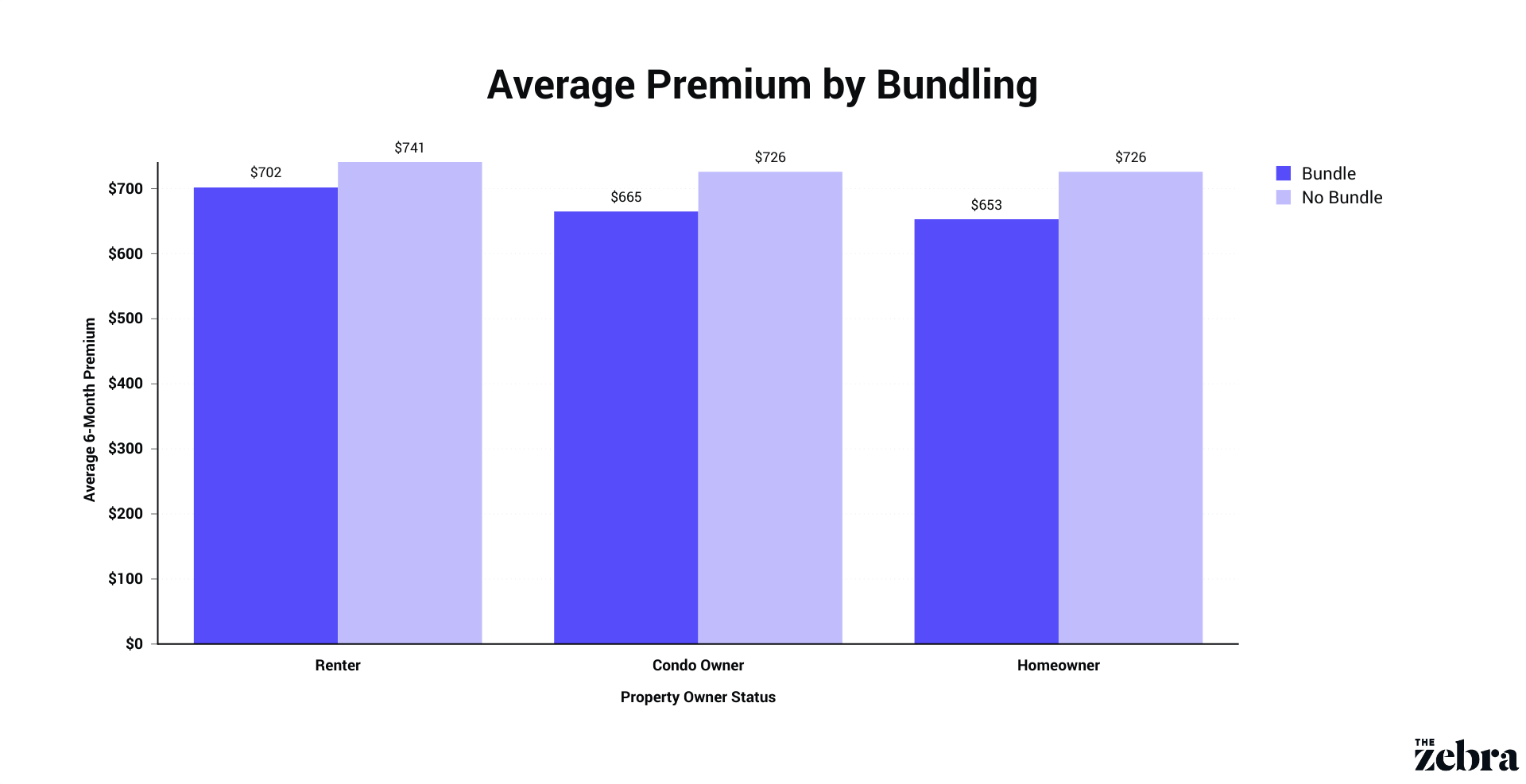

Source: thezebra.com

Source: thezebra.com

This is closely followed by home insurance costs in Alberta at around 900 per year. The average home insurance rate is about 2305 per year. Homeowners Insurance in Canada. The average auto insurance in Ontario is over 1500 a year. Renters Insurance What To Know Before You Rent The Zebra.

Source: sonnet.ca

Source: sonnet.ca

Posted on April 4 2018. Is your homeowners insurance included in your mortgage payment. The home insurance market is unregulated making data on premiums hard to find. But Quebec residents only pay an average of 717 a 1115 price difference. Home Insurance Quote And Buy Homeowners Insurance Online Sonnet Insurance.

Source: thinkinsure.ca

Source: thinkinsure.ca

Driving up and down the 401 doesnt come cheap. Note that the dollar differences in parenthesis are those that are greater than the national average. In 2015 Ontario was the most expensive with average premiums of 1281 per year but its 247 hike doesn. The average home insurance cost per month is 9933 according to the National Association of Insurance Commissioners 2018 home insurance report. Alberta Home Insurance Compare Cheap Quotes Online Thinkinsure.

Source: ratehub.ca

Source: ratehub.ca

Ontariothe most populous provinceis the second most expensive province when it comes to car insurance. Protect your home budget. Own a home in BC. The average home insurance rate is about 2305 per year. Compare Home Insurance Quotes Home Condo Tenants Ratehub Ca.

Source: canadadrives.ca

Source: canadadrives.ca

Get your quote today. The average cost of home insurance in the UK is 163 based on data published from the second quarter of 2018 by the AAs British insurance premium index. Renters insurance covers additional living costs such as hotel rooms so you can relax while your home is being restored to its former glory. In 2015 Ontario was the most expensive with average premiums of 1281 per year but its 247 hike doesn. 13 Ways To Get Cheap Car Insurance.

Source: canadianunderwriter.ca

Source: canadianunderwriter.ca

But Quebec residents only pay an average of 717 a 1115 price difference. House insurance in the United States costs about 1200 on average. The house prices rose in the province until 2018 but are set to. Ontariothe most populous provinceis the second most expensive province when it comes to car insurance. How Home Insurance Rates In Canada Are Trending.

The average auto insurance in Ontario is over 1500 a year. Why are home insurance rates rising so quickly. Is 625 for an HO6 policy. The home insurance cost in British Columbia is considered most expensive ranging around 920 per year. Mobile Home Insurance Do You Need It And What It Covers Valuepenguin.

Source: pinterest.com

Source: pinterest.com

According to a new report from the Insurance Bureau of Canada IBC British Columbia drivers pay 1832 on average for their insurance coverage annually. Lets take a look at what a monthly mortgage would look like using the average house price in BC. The monthly payments amount to 2371. According to a 2018 survey from JD. Pin On Life Insurance And Investments.

Source: canadianunderwriter.ca

Source: canadianunderwriter.ca

Note that the dollar differences in parenthesis are those that are greater than the national average. Protect your home budget. This is closely followed by home insurance costs in Alberta at around 900 per year. On average house insurance cost in Canada is about 30 cheaper than in the United States. How Home Insurance Rates In Canada Are Trending.

Source: forbes.com

Source: forbes.com

The highest level of home insurance. Placed third and fourth on the list are Alberta 1251 and Newfoundland Labrador 1132 while Manitoba rounds out the top five with an annual average premium of 1080. This is 38 higher than the year before. The average auto insurance in Ontario is over 1500 a year. Best Car Insurance Companies Of December 2021 Forbes Advisor.