Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a 1665 billion settlement with Bank of America Corporation the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current. The bank was required to participate in HAMP as a condition of receiving a 45 billion bailout from the federal government to shore up the banks bad loans during the 2008 financial crisis. Bank of america home loan modification settlement.

Bank Of America Home Loan Modification Settlement, Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a 1665 billion settlement with Bank of America Corporation the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current. A consumer banking deceptive practices class action lawsuit has been filed alleging that Bank of America NYSEBAC created and headed an illegal enterprise designed to defraud homeowners seeking loan modifications as part of the government Home Affordable Modification Program or HAMP. Bank of America is allowed to use federal incentives under President Obamas 75 billion Home Affordable Modification Program HAMP toward the loan modifications it is required to make as the. Bank of America shall bear all reasonable costs and expenses of.

5 Last Minute Romantic Trips Romantic Travel Weekend Getaways In The South Weekend Getaways For Couples From nl.pinterest.com

5 Last Minute Romantic Trips Romantic Travel Weekend Getaways In The South Weekend Getaways For Couples From nl.pinterest.com

Bank of america loan modification settlement. Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a 1665 billion settlement with Bank of America Corporation the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current. Bank of America hired Urban Settlement Services dba Urban Lending Solutions to administer its Home Affordable Modification Program or HAMP. Several homeowners benefited from this loan modification program but if you were a Bank of America customer you may have been wrongly denied this benefit.

Department of Justice has completed an investigation into Bank of Americas handling of loan modification requests which uncovered facts suggesting the company intentionally delayed or wrongly denied many homeowners requests to.

Read another article:

A consumer banking deceptive practices class action lawsuit has been filed alleging that Bank of America NYSEBAC created and headed an illegal enterprise designed to defraud homeowners seeking loan modifications as part of the government Home Affordable Modification Program or HAMP. Within thirty 30 days of entry of this Agreement Bank of America shall enter into a contract retaining a Settlement Administrator Administrator to conduct the activities set forth. While bank of america doesnt offer personal loans there are a variety of similar lenders who offer comparable products. February 24 2020. Bank of America BoA and BAC Home Loans Servicing are facing a potential class action lawsuit over allegations that they refused to participate in foreclosure prevention programs even though they had accepted 25 billion in financing from the federal government through the.

Source: pinterest.com

Source: pinterest.com

A lawsuit accusing Bank of America Corp of reneging on promises to help distressed homeowners modify their mortgage loans and instead driving them into foreclosure cannot proceed as a. Bank of america loan modification settlement. Bank of America Faces Home Loan Modification Class Action. Several homeowners benefited from this loan modification program but if you were a Bank of America customer you may have been wrongly denied this benefit. 2021 Stimulus And Bankruptcy In 2021 Loan Modification Mortgage Debt Bankruptcy.

Source: acgnow.com

Source: acgnow.com

While BOA participated in the HAMP program as a condition of accepting the TARP money it did everything it could to thwart homeowners seeking a HAMP mortgage modification. Find out more about what bank of america offers or select a. While BOA participated in the HAMP program as a condition of accepting the TARP money it did everything it could to thwart homeowners seeking a HAMP mortgage modification. The lawsuit claims that Bank of America is guilty of violating the Racketeering Influenced Corrupt Organizations Act or RICO. Us Bank Rma Loan Modification Forms Check List And Packagepdf.

Source: fha.com

Source: fha.com

The lawsuit claims that Bank of America is guilty of violating the Racketeering Influenced Corrupt Organizations Act or RICO. Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a 1665 billion settlement with Bank of America Corporation the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current. Treasury-Index T-Bill or the Secured. Bank of America BoA and BAC Home Loans Servicing are facing a potential class action lawsuit over allegations that they refused to participate in foreclosure prevention programs even though they had accepted 25 billion in financing from the federal government through the. 2021 Fha Requirements Your Loan And Closing Checklists.

Source: pinterest.com

Source: pinterest.com

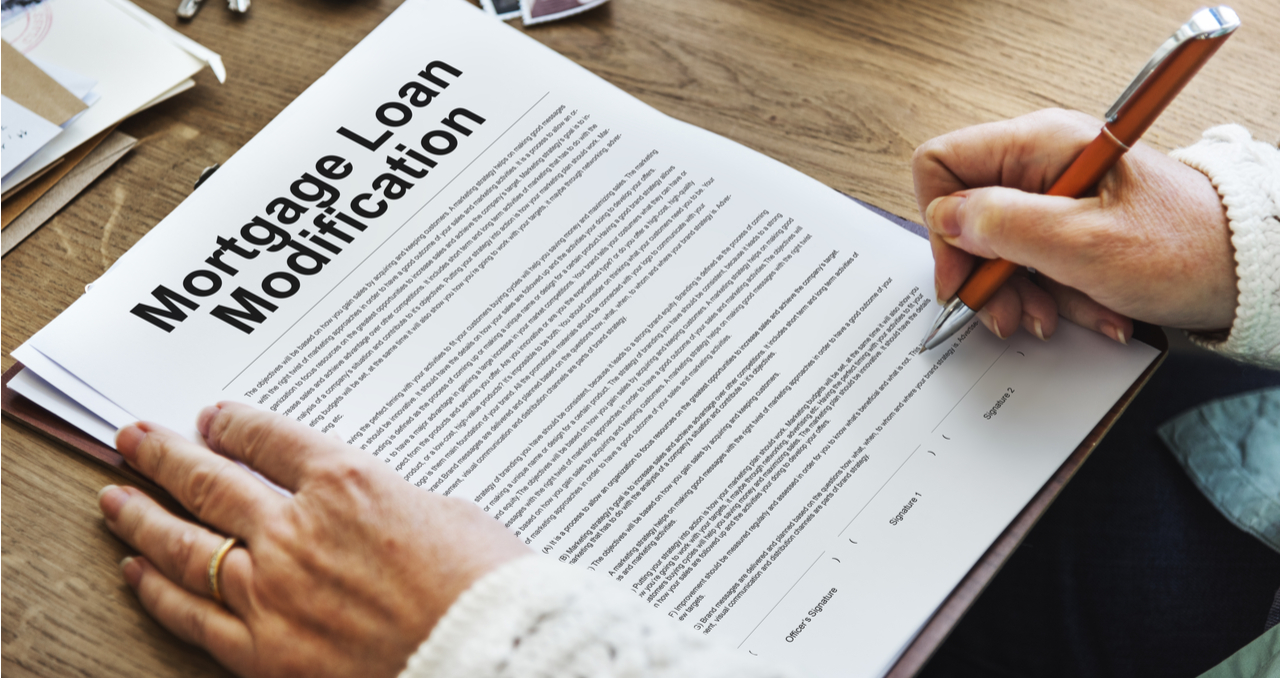

The Modification Agreement defines the changes to your home loan. Several homeowners benefited from this loan modification program but if you were a Bank of America customer you may have been wrongly denied this benefit. A home loan with an interest rate that remains the same for the entire term of the loan. Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a 1665 billion settlement with Bank of America Corporation the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current. Hardship Letter Template 16 Financial Lettering Medical Billing.

Source: listwithclever.com

Source: listwithclever.com

Find out more about what bank of america offers or select a. A 250 million settlement has been proposed in a class action lawsuit filed against Bank of America and Countrywide Financial Corp by mortgage borrowers who claim that the two companies participated in a real estate appraisal scheme. The bank was required to participate in HAMP as a condition of receiving a 45 billion bailout from the federal government to shore up the banks bad loans during the 2008 financial crisis. Bank of America Faces Home Loan Modification Class Action. Can I Sell My Home After A Loan Modification An Honest Guide.

Source: fha.com

Source: fha.com

While other banks customers were being approved on their HAMP modification applications almost 90 of the time BOA customers were being approved at close to 30. Bank of America hired Urban Settlement Services dba Urban Lending Solutions to administer its Home Affordable Modification Program or HAMP. Several homeowners benefited from this loan modification program but if you were a Bank of America customer you may have been wrongly denied this benefit. The Modification Agreement defines the changes to your home loan. Can I Finance A Tiny Home With An Fha Mortgage.

Source: theguardian.com

Source: theguardian.com

It asks for damages to be awarded to a proposed class defined as. Among claims in the latest suit. Bank of America shall bear all reasonable costs and expenses of. Bank of America has also agreed to pay as much as 490 million to homeowners who face larger tax bills after their mortgages are modified. Bank Of America S Countrywide Found Guilty Of Mortgage Fraud Us Housing And Sub Prime Crisis The Guardian.

Source: nytimes.com

Source: nytimes.com

Department of Justice has uncovered several facts suggesting that Bank of America intentionally delayed or wrongfully denied homeowners requests for refinancing their mortgage. Treasury-Index T-Bill or the Secured. Department of Justice has completed an investigation into Bank of Americas handling of loan modification requests which uncovered facts suggesting the company intentionally delayed or wrongly denied many homeowners requests to. Department of Justice has uncovered several facts suggesting that Bank of America intentionally delayed or wrongfully denied homeowners requests for refinancing their mortgage. As Banks Retreat Private Equity Rushes To Buy Troubled Home Mortgages The New York Times.

Source: in.pinterest.com

Source: in.pinterest.com

Once completed we are required to report the modification to the credit bureaus which may negatively impact your credit. Bank of America is allowed to use federal incentives under President Obamas 75 billion Home Affordable Modification Program HAMP toward the loan modifications it is required to make as the. Recently the attorney generals of New York and Florida accused Bank of America of violating the terms of last years settlement. The Modification Agreement defines the changes to your home loan. Jp Morgan Processing Refinance Mortgage And Modifications Refinance Mortgage Mortgage Modification.

Source: housing.com

Source: housing.com

The bank was required to participate in HAMP as a condition of receiving a 45 billion bailout from the federal government to shore up the banks bad loans during the 2008 financial crisis. Bank of America shall bear all reasonable costs and expenses of. Lost documentation months of lies pro. Report on how Bank of America drags their feet on loan modification with the sole intent on foreclosing on your home. Home Loan Sanction Letter Meaning Format Importance In Loan Approval.

Source: pinterest.com

Source: pinterest.com

Bank of America hired Urban Settlement Services dba Urban Lending Solutions to administer its Home Affordable Modification Program or HAMP. A home loan with an interest rate that remains the same for the entire term of the loan. Several homeowners benefited from this loan modification program but if you were a Bank of America customer you may have been wrongly denied this benefit. Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a 1665 billion settlement with Bank of America Corporation the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current. A 30 Day Notice To Vacate Also Known As A 30 Day Notice 30 Day Notice To Move And 30 Day Notice To Quit Is A Notice That La House Styles Afghanistan Mansions.

Source: nl.pinterest.com

Source: nl.pinterest.com

Report on how Bank of America drags their feet on loan modification with the sole intent on foreclosing on your home. While BOA participated in the HAMP program as a condition of accepting the TARP money it did everything it could to thwart homeowners seeking a HAMP mortgage modification. Bank of America is allowed to use federal incentives under President Obamas 75 billion Home Affordable Modification Program HAMP toward the loan modifications it is required to make as the. The Modification Agreement defines the changes to your home loan. 5 Last Minute Romantic Trips Romantic Travel Weekend Getaways In The South Weekend Getaways For Couples.

Source: pinterest.com

Source: pinterest.com

The Modification Agreement defines the changes to your home loan. While bank of america doesnt offer personal loans there are a variety of similar lenders who offer comparable products. While other banks customers were being approved on their HAMP modification applications almost 90 of the time BOA customers were being approved at close to 30. The Modification Agreement defines the changes to your home loan. Pin On Numerology April 2012.

Source: in.pinterest.com

Source: in.pinterest.com

AP PhotoElise Amendola File CN More than 100 Florida homeowners claim Bank of America fraudulently delayed or destroyed their applications to modify the terms of their mortgages to steal their homes and sell them at a profit. Bank of america loan modification settlement. The government created HAMP in 2009 in response to the foreclosure epidemic and to encourage banks to give homeowners loan modifications allowing some borrowers to stay in their homes. The Modification Agreement defines the changes to your home loan. Celebrate Every Moment Of Your Living At Saltee Splendora Realestatekolkata Realestate In This Moment Celebrities Celebration Of Life.

Source: apexhomeloans.com

Source: apexhomeloans.com

While bank of america doesnt offer personal loans there are a variety of similar lenders who offer comparable products. Adjustable-rate mortgage ARM Also called a variable-rate mortgage an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the US. February 24 2020. Find out more about what bank of america offers or select a. What Is Title Insurance 10 Common Questions You Should Ask.