The Aviva Flexible Plan on the other hand offers you a single lump sum and a drawdown option. 3A1 Home reversion plans It is an arrangement that includes the following characteristics. Aviva home reversion plan.

Aviva Home Reversion Plan, This could be more cost-effective than a single lump-sum loan as theyll only pay interest on. Aviva Capital Lump Sum Equity Release. This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. Its often found to encounter individuals looking for home reversion plans monthly payment lifetime the mortgage or home reversion schemes however Key Solutions like Legal General are eager to see paperwork to show your circumstances in the form of pension.

A 1 96 Mer Aviva Equity Release Interest Only Mortgage 2021 From frequentfinance.co.uk

A 1 96 Mer Aviva Equity Release Interest Only Mortgage 2021 From frequentfinance.co.uk

Howe initially wanted more information on the Home Reversion plan but once we established her needs it become apparent a lifetime mortgage scheme was more ideal because. Well then arrange an independent valuation of your home and confirm exactly how much money you can release provided it meets our requirements. As well as cash either as a lump sum or income youll get a lifetime lease a promise that you can stay in your home until you die or move into care. Aviva is the rebranded name of norwich union and is one of the longest serving providers of equity release plans today.

Aviva is the rebranded name of norwich union and is one of the longest serving providers of equity release plans today.

Read another article:

The Aviva Flexible Plan on the other hand offers you a single lump sum and a drawdown option. A monthly payment lifetime mortgage can reduce the value of your estate like an Aviva Equity Release plan can. How does a home reversion plan work. Aviva has been providing home reversion plans as well as lifetime mortgages to homeowner over the years via Grainger PLC. A home reversion plan sees you selling a stake in your property in return for a cash lump sum.

Source: yourtime.co.uk

Source: yourtime.co.uk

We lobbied the Treasury back in 2002 on this issue and called on them to introduce full regulation of both Lifetime Mortgages and Home Reversion Plans. As well as receiving an initial lump sum of 10000 or more your client can set up a cash reserve of 5000 or more from which they can draw money when they need it. This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. A monthly payment lifetime mortgage can reduce the value of your estate like an Aviva Equity Release plan can. Aviva Lifeitme Mortgage Your Time Equity Release Experts.

Source: ftadviser.com

Source: ftadviser.com

A monthly payment lifetime mortgage can reduce the value of your estate like an Aviva Equity Release plan can. Two variants of plan. Home reversion schemes may impact entitlements to state benefits. Home reversion plans have seen a marked decline in popularity in recent times. Aviva Introduces Lower Minimum Drawdown For Equity Release Ftadviser Com.

![]() Source: vimeo.com

Source: vimeo.com

3A1 Home reversion plans It is an arrangement that includes the following characteristics. Eligibility criteria for home reversion plans to be eligible for a home reversion plan you will usually need to own a property valued at 80000 or more and be at least 55 years old. Aviva Flexible Plan The Lifetime Lump Sum Max Plan enables you to unlock a one-off cash lump sum starting at 15000. Howe initially wanted more information on the Home Reversion plan but once we established her needs it become apparent a lifetime mortgage scheme was more ideal because. Aviva Tv Ad Equity Release On Vimeo.

Source: aviva.com

Source: aviva.com

1D Comparing lifetime mortgages with home reversion plans A Home reversion plan is not a mortgage or even any type of loan. Aviva Home Reversion Plan Heres how to sell a house with a reverse mortgage. Eligibility criteria for home reversion plans to be eligible for a home reversion plan you will usually need to own a property valued at 80000 or more and be at least 55 years old. 1D Comparing lifetime mortgages with home reversion plans A Home reversion plan is not a mortgage or even any type of loan. Aviva Announces New Flexible Repayment Options To Equity Release Aviva Plc.

This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. The Norwich Union Home Reversion Plan is offered by Norwich Union Equity Release Limited on behalf of Grainger Trust plc and their subsidiaries the UKs largest residential property investor quoted on the stock exchange. - 6 - v2018 Aviva. Home reversion schemes may impact entitlements to state benefits. 2.

Source: moneyrelease.co.uk

Source: moneyrelease.co.uk

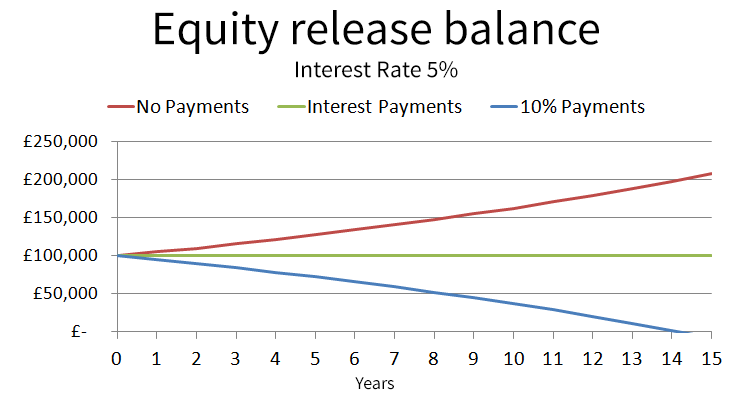

Aviva Home Reversion Plan Heres how to sell a house with a reverse mortgage. Most people choose the home reversion plan because it provides them with the option of being able to leave an inheritance. This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. As well as cash either as a lump sum or income youll get a lifetime lease a promise that you can stay in your home until you die or move into care. Can I Repay My Equity Release With Examples Video.

Source: timhales.co.uk

Source: timhales.co.uk

However they have now decided to withdraw its home reversion plan with immediate effect. However they have now decided to withdraw its home reversion plan with immediate effect. We lobbied the Treasury back in 2002 on this issue and called on them to introduce full regulation of both Lifetime Mortgages and Home Reversion Plans. Aviva has been providing home reversion plans as well as lifetime mortgages to homeowner over the years via Grainger PLC. Put Your Plans Into Action Tim Hales.

Source: aviva.co.uk

Source: aviva.co.uk

Yes Aviva Equity Release is 207 MER. Aviva Capital Lump Sum Equity Release. How does a home reversion plan work. Aviva Home Reversion Plan Heres how to sell a house with a reverse mortgage. Manage Your Equity Release Plan Aviva.

Source: aviva.co.uk

Source: aviva.co.uk

Home reversion will never enable the customer to raise the full value of the property as the finance provider has to balance reward with risk. This could be more cost-effective than a single lump-sum loan as theyll only pay interest on. Home reversion plans were much more popular when the only alternative in the equity release. A monthly payment lifetime mortgage can reduce the value of your estate like an Aviva Equity Release plan can. What Is Equity Release How Lifetime Mortgages Work Aviva.

![]() Source: vimeo.com

Source: vimeo.com

Home reversion is different because it is a sale of all or part of your home. UK Equity Release Scheme Lenders. Its often found to encounter individuals looking for home reversion plans monthly payment lifetime the mortgage or home reversion schemes however Key Solutions like Legal General are eager to see paperwork to show your circumstances in the form of pension. If you decide to go ahead you can complete your application form with your financial adviser. Aviva Equity Release Dolls House On Vimeo.

Source: frequentfinance.co.uk

Source: frequentfinance.co.uk

Yes Aviva Equity Release is 207 MER. Reversion provider buys all or part of a qualifying interest in land. 1D Comparing lifetime mortgages with home reversion plans A Home reversion plan is not a mortgage or even any type of loan. Simple business plan for home business startup one of the first things budding home business owners are encouraged to do is write a business plan. A 1 96 Mer Aviva Equity Release Interest Only Mortgage 2021.

Source: timhales.co.uk

Source: timhales.co.uk

We compare UK Equity Release Providers. Home reversion schemes may impact entitlements to state benefits. Discuss your plans and options with your family and decide whether a lifetime mortgage is right for you. By selling a share of your property you become a co-owner but continue to enjoy the right to live in it for the rest of your life. Put Your Plans Into Action Tim Hales.

Source: mortgagesolutions.co.uk

Source: mortgagesolutions.co.uk

Home reversion plans were much more popular when the only alternative in the equity release. Well then arrange an independent valuation of your home and confirm exactly how much money you can release provided it meets our requirements. Luna Howe Released 50000 Joseph was a returning client whom had taken out a Papilio mortgage in the past and wanted to re-broke it following Avivas slash in interest rates. Yes Aviva Equity Release is 207 MER. Aviva To Give New Equity Release Borrowers Choice Of Fixed Or Gilt Based Ercs Mortgage Solutions.

Source: moneyrelease.co.uk

Source: moneyrelease.co.uk

Reversion provider buys all or part of a qualifying interest in land. 3A1 Home reversion plans It is an arrangement that includes the following characteristics. This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. Home reversion is different because it is a sale of all or part of your home. Are Aviva Equity Release Plans Any Good My Honest Review.

Source: trustpms.com

Source: trustpms.com

3A1 Home reversion plans It is an arrangement that includes the following characteristics. Eligibility criteria for home reversion plans to be eligible for a home reversion plan you will usually need to own a property valued at 80000 or more and be at least 55 years old. Luna Howe Released 50000 Joseph was a returning client whom had taken out a Papilio mortgage in the past and wanted to re-broke it following Avivas slash in interest rates. This could be more cost-effective than a single lump-sum loan as theyll only pay interest on. Aviva.