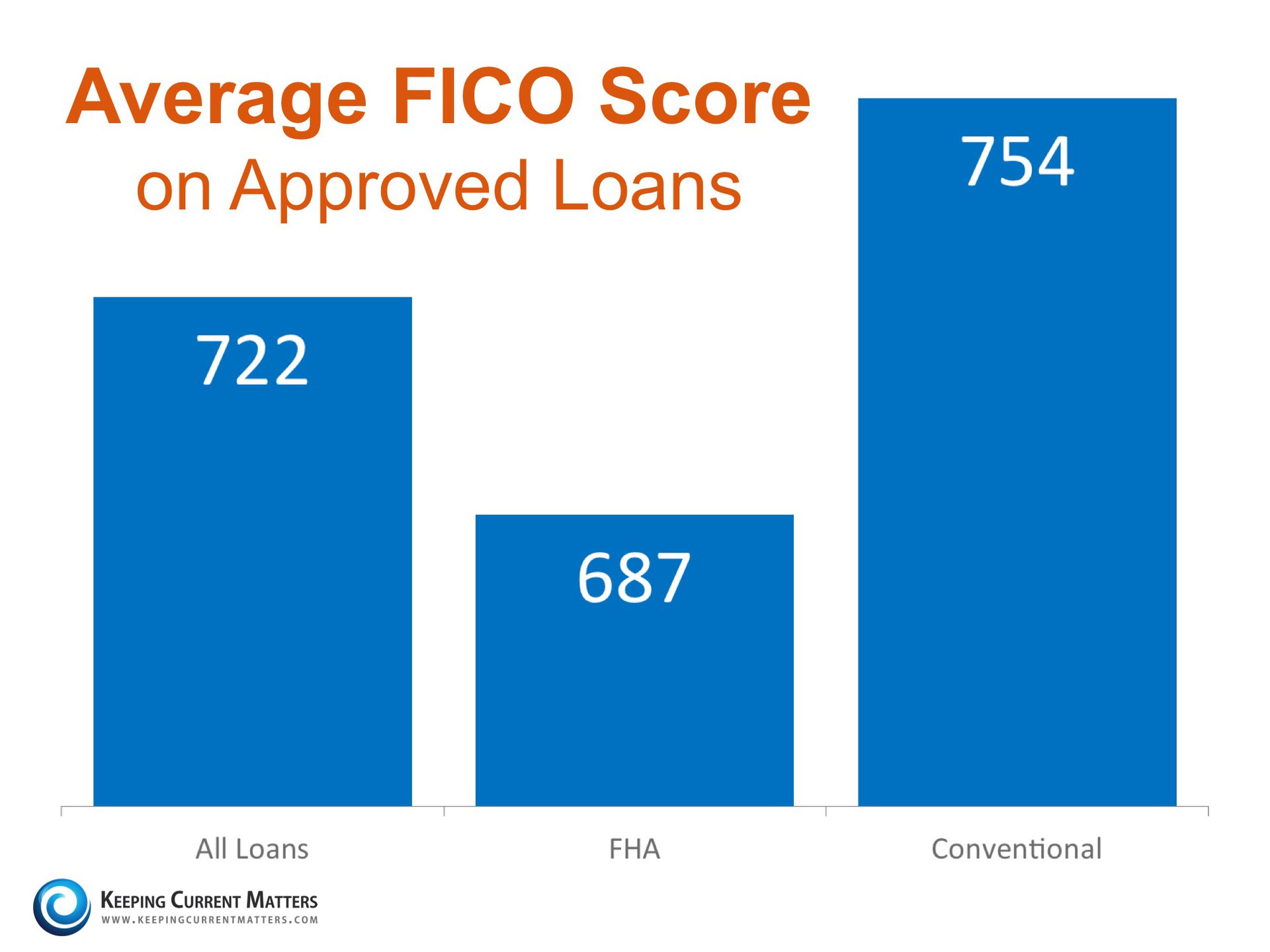

A fair credit score 650 to 699. Higher credit scores can open the doors to some very attractive perks. Average credit score for first time home buyers.

Average Credit Score For First Time Home Buyers, You are in the right place. A Credit Karma survey found the average credit score for US. Average Credit Scores for Home Buyers Are Rising. First-Time Homebuyer Requirements Credit A minimum 620 credit score is required for a mortgage except FHA and VA loans which you can be approved with a 580 credit score.

Need To Repair Your Credit If You Re Buying A Home A Low Credit Score Can Save You Thousand Credit Repair Services Credit Repair Business Improve Credit Score From pinterest.com

Need To Repair Your Credit If You Re Buying A Home A Low Credit Score Can Save You Thousand Credit Repair Services Credit Repair Business Improve Credit Score From pinterest.com

But there is still room for improvement. However many lenders require a score of 620 to 640 to qualify. A fair credit score 650 to 699. FHA 203K Loan 620 credit score.

Assuming a 2 percent inflation rate the maximum first-time home buyer tax credit would increase as follows over the next five years.

Read another article:

Higher credit scores can open the doors to some very attractive perks. First lets talk about credit scores. Credit Score to Buy a House. And it appears that this sage advice is becoming even more relevant today. But there is still room for improvement.

Source: ru.pinterest.com

Source: ru.pinterest.com

However many lenders require a score of 620 to 640 to qualify. Average Credit Score to Buy a House in 2020 Credit Karma. Minimum 620 credit score. Borrowers need just a 3 down payment. Workout Your Credit And Budget For Your Home Loan Before Shopping Mortgage Mortgageloan Financialplanning Financ Mortgage Tips Home Loans Online Mortgage.

Source: pinterest.com

Source: pinterest.com

Expand your knowledge of home goods. However it is possible to. Chapters include budgeting Home prices rising Interest rate. First-Time Homebuyer Requirements Credit A minimum 620 credit score is required for a mortgage except FHA and VA loans which you can be approved with a 580 credit score. Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic.

Source: br.pinterest.com

Source: br.pinterest.com

You are in the right place. Credit Score to Buy a House. First-Time Homebuyer Requirements Credit A minimum 620 credit score is required for a mortgage except FHA and VA loans which you can be approved with a 580 credit score. Here you can find everything about Good Credit Score For First Time Home Buyer. What Credit Score Is Needed To Buy A Car Credit Repair Business Credit Score Credit Repair.

Source: fi.pinterest.com

Source: fi.pinterest.com

Assuming a 2 percent inflation rate the maximum first-time home buyer tax credit would increase as follows over the next five years. Just remember that low credit is not the same as bad credit. Mortgage reforms that were put in place following the housing market crisis of 2007 and 2008 make it more difficult for consumers with low credit scores to qualify for home loans. For example conventional loans let you buy a house with 3 down and a 620 credit score and FHA loans allow a 35 down. Pin Auf Credit Repair.

Source: pinterest.com

Source: pinterest.com

First-Time Homebuyer Requirements Credit A minimum 620 credit score is required for a mortgage except FHA and VA loans which you can be approved with a 580 credit score. But there is still room for improvement. Maximum tax credit of 15000. FICO credit scores range from 350-850 points with higher scores indicating less credit risk for lenders. A Rare Glimpse Inside The Fico Credit Score Formula Fico Credit Score Credit Score Credit Solutions.

Source: pinterest.com

Source: pinterest.com

Higher credit scores can open the doors to some very attractive perks. Chapters include budgeting Home prices rising Interest rate. Good Credit Score For First Time Home Buyer. A minimum of 580 is needed to make the minimum down payment of 35. Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval Louisville Kentucky Mortgage Loans No Credit Loans Bad Credit Mortgage Credit Score.

Source: pinterest.com

Source: pinterest.com

Just remember that low credit is not the same as bad credit. Score and what number is best to buy a home. Americans credit scores jumped in 2020. In addition to down payment myths buyers are often confused about their credit score assuming that any score below 700 will be disqualifying when purchasing a home. The Average Credit Score To Qualify For A Mortgage Is Now Very High Average Credit Score Credit Score Scores.

Source: pinterest.com

Source: pinterest.com

In addition to down payment myths buyers are often confused about their credit score assuming that any score below 700 will be disqualifying when purchasing a home. The average FICO score reached 710 Experians 2020 Consumer Credit Review highlights. Youve heard it time and time again that a solid credit score is vital to securing a good mortgage rate or any mortgage at all. A good credit score is from 700 to 749. Credit Score Information For Kentucky Home Buyers Credit Score Mortgage Loans Fha Loans.

Source: pinterest.com

Source: pinterest.com

Mortgage reforms that were put in place following the housing market crisis of 2007 and 2008 make it more difficult for consumers with low credit scores to qualify for home loans. A Credit Karma survey found the average credit score for US. You are in the right place. Improving National home buyer First Time Home Buyer 2018 First Time Home Buyer Pre Qualification The steps to buy a house might seem complicated at firstparticularly if youre a first-time home buyer dipping. How To Get An 800 Credit Score Before You Turn 25 Credit Score Better Money Habits How To Get.

Source: ar.pinterest.com

Source: ar.pinterest.com

Generally most mortgage loans require a credit score of 620 or higher. Average Credit Scores for Home Buyers Are Rising. FHA 203K Loan 620 credit score. Credit scores are maintained by the national credit bureaus and include debt like credit cards auto loans or student loans. Pin Auf Board For First Time Buyers.

Source: pinterest.com

Source: pinterest.com

You are in the right place. The HomeReady and Home Possible Loan programs are mortgage loans for low-income created by Fannie Mae and Freddie Mac for low-income first-time homebuyers with a 620 or higher credit score. Your credit score commonly called a FICO Score can range from 300 at the low end to 850 at the high end. First Time Home Buyer Credit Qualifications Pocketsense Generally people buying a home for the first time must have a a credit score of 620 or higher for loan approval with scores of 750 or higher needed for the lowest interest rates. Credit Scoring Algorithm Myths Busted What Is Credit Score Improve Your Credit Score Credit Score.

Source: es.pinterest.com

Source: es.pinterest.com

You are in the right place. The credit score needed for first time home buyers is of the following range. Want to know more about Good Credit Score For First Time Home Buyer. The average FICO score reached 710 Experians 2020 Consumer Credit Review highlights. Do I Need Perfect Credit To Buy A Home Infographic Blog Boca Raton Fort Lauderdale Homes Home Buying Home Buying Tips Real Estate Infographic.

Source: pinterest.com

Source: pinterest.com

Improving National home buyer First Time Home Buyer 2018 First Time Home Buyer Pre Qualification The steps to buy a house might seem complicated at firstparticularly if youre a first-time home buyer dipping. Conventional Loan 620 credit score. Youve heard it time and time again that a solid credit score is vital to securing a good mortgage rate or any mortgage at all. The average credit score for a home buyer jumped to 745. What You Really Need To Qualify For A Mortgage Keeping Current Matters Fico Score Scores Mortgage.

Source: pinterest.com

Source: pinterest.com

First time home buyers get access to many low-down-payment mortgages. FHA 203K Loan 620 credit score. However many lenders require a score of 620 to 640 to qualify. For example conventional loans let you buy a house with 3 down and a 620 credit score and FHA loans allow a 35 down. Credit Scores By State Credit Repair Services Credit Score Credit Repair.

Source: pinterest.com

Source: pinterest.com

Your credit score commonly called a FICO Score can range from 300 at the low end to 850 at the high end. The tax credit is equal to 10 of your homes purchase price and may not exceed 15000 in 2021 inflation-adjusted dollars. Americans credit scores jumped in 2020. Equifax Experian and TransUnion all with slightly different methods to determine your credit score. What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan Mortgage Loans Buying Your First Home Credit Score.