According to data released this year the average closing. This is a fee you may have to pay when refinancing internally staying with your current lender but switching to a different mortgage product. Average cost of refinancing home loan.

Average Cost Of Refinancing Home Loan, 2300 plus 1 of. A 400000 loan amount variable fixed. 221 Comparison Rate. Step 4 Consider a no-closing-cost refi.

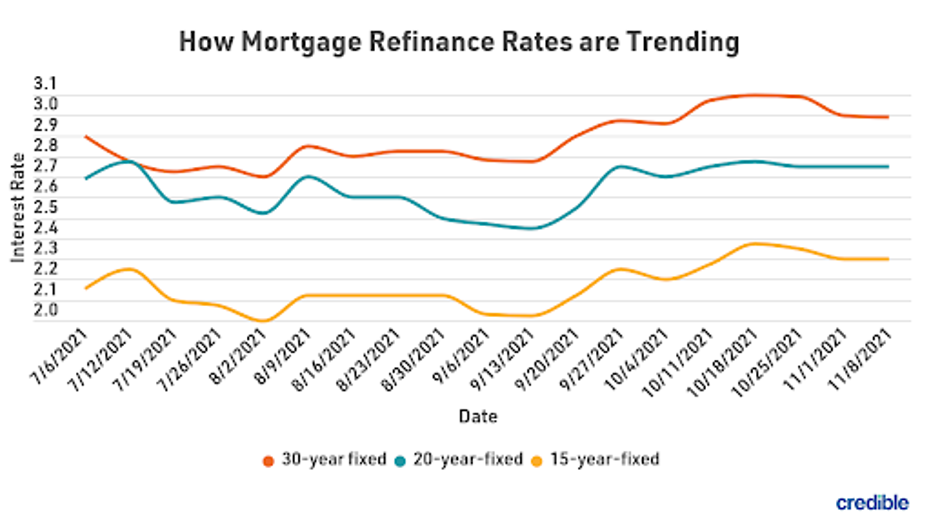

The Cost To Refinance A Mortgage And How To Pay Less From credible.com

The Cost To Refinance A Mortgage And How To Pay Less From credible.com

Speak up and ask for a better deal. The housing finance data from the Australian Bureau of Statistics June quarter revealed that an estimated 40 billion worth of home loans had been refinanced since March. 2040 according to ClosingCorp data Property taxes will be one of your more significant expenses when refinancing and costs vary based on where you live and your homes value. Apply for a loan with three to five lenders and compare their refinance fees.

Step 4 Consider a no-closing-cost refi.

Read another article:

The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you live according to data from Freddie. Prepayment Penalty - Some lenders charge a penalty fee if you pay off your home mortgage loan early. 4 rows Based on your creditworthiness you may be matched with up to five different lenders. Its always worth asking your lender if. Refinancing a home loan can improve a familys monthly cash flow.

Source:

Source:

Your loan amount There are closing costs associated with refinancing your mortgage and can be as high as getting a new loan. The cost of this home refinance item will usually average between 400 and 700. As you can see in the table below refinancing can potentially be very cheap but also very expensive. Refinancing occurs when an individual or an organization revises its terms of finance including repayment schedule rate of interest credit etc. Ayjxzfxxhedz2m.

Source: pinterest.com

Source: pinterest.com

Speak up and ask for a better deal. According to data released this year the average closing. Refinancing a home loan can improve a familys monthly cash flow. However the process of rewriting a home loan is not free and knowing the typical refinance costs will be important for anyone thinking about jumping in. Infographic How 203k Works Renovation Loan Center Renovation Loans Home Renovation Loan Home Improvement.

Source: foxbusiness.com

Source: foxbusiness.com

The average American mortgage refinance costs between 3 and 6 percent of the home loans value. These tend to add up to roughly 2-5 of your loan principal. Refinancing occurs when an individual or an organization revises its terms of finance including repayment schedule rate of interest credit etc. Step 3 Negotiate your refi costs. Today S Mortgage Refinance Rates Hold At Bargain Lows But The Clock S Ticking Nov 15 2021 Fox Business.

Source: pinterest.com

Source: pinterest.com

As you can see in the table below refinancing can potentially be very cheap but also very expensive. At the end of 2020 the median purchase price in. Step 3 Negotiate your refi costs. 4 rows Based on your creditworthiness you may be matched with up to five different lenders. What Are The Typical Closing Costs On A Refinance Refinancing Mortgage Refinance Mortgage Mortgage.

Source: pinterest.com

Source: pinterest.com

Refinancing a home loan can improve a familys monthly cash flow. See the benefits of a Smart Refinance. Usually refinancing costs the average home owner between 3 and 6 percent of the home loans value. Some of the fees associated with refinancing can be negotiated. Another Great Infographic Created By Me Should You Refinance Here S A Great Infographic That Can Hel Mortgage Infographic Mortgage Tips Refinancing Mortgage.

Source: pinterest.com

Source: pinterest.com

Usually refinancing costs the average home owner between 3 and 6 percent of the home loans value. These tend to add up to roughly 2-5 of your loan principal. At the end of 2020 the median purchase price in. The majority of lenders will require you to pay a fee for refinancing your loan like legal fees valuation fees. Loans Archives Napkin Finance Personal Finance Budget Finance Investing Refinance Mortgage.

Source: pinterest.com

Source: pinterest.com

Expect to pay 2 3 of your loan balance in closing costs. Refinancing can also reduce the mortgage term for long term savings and provide ready cash drawn from the homes equity. Refinancing a home loan can improve a familys monthly cash flow. As with all other costs be sure to get the exact amount in advance. As A Mortgage Broker We Have Access To Lender A B C And Everyone Else We Find You The Best Deal That Mortgage Loans Refinance Mortgage Refinancing Mortgage.

Source: pinterest.com

Source: pinterest.com

Refinancing a home loan can improve a familys monthly cash flow. Make certain that you understand ALL of the fees involved in a refinance as lenders have been known to hide costs within the fine print. However the process of rewriting a home loan is not free and knowing the typical refinance costs will be important for anyone thinking about jumping in. Refinancing can also reduce the mortgage term for long term savings and provide ready cash drawn from the homes equity. What To Consider Before Refinancing Your Home State Farm Finance Jobs Finance Meaning Finances Money.

Source: pinterest.com

Source: pinterest.com

Refinancing a home loan can improve a familys monthly cash flow. At the end of 2020 the median purchase price in. Expect to pay 2 3 of your loan balance in closing costs. 221 Comparison Rate. What Are Pre Approved Home Loans Why You Should Consider Them Home Loans Loan Home.

Source: investopedia.com

Source: investopedia.com

One big thing holding people back from pulling the trigger. 2300 plus 1 of. For example if a borrower is refinancing a 100000 mortgage the. You can pay a switching fee of between 250-650 to switch loan products. How Much Does Refinancing A Mortgage Cost.

Source: pinterest.com

Source: pinterest.com

Title insurance and search. Step 3 Negotiate your refi costs. You may be able to roll your closing costs into your loan balance depending on your lenders requirements. How Much Does it Cost to Refinance. The Math Behind The Mortgage Mortgage Tips Refinance Mortgage Home Loans.

Source: pinterest.com

Source: pinterest.com

About 1 of your principal balance. Its always worth asking your lender if. The majority of lenders will require you to pay a fee for refinancing your loan like legal fees valuation fees. 2040 according to ClosingCorp data Property taxes will be one of your more significant expenses when refinancing and costs vary based on where you live and your homes value. Mortgage Loan In Mumbai Lowest Mortgage Rates Mortgage Interest Rates Mortgage Lenders.

Source: valuepenguin.com

Source: valuepenguin.com

Make certain that you understand ALL of the fees involved in a refinance as lenders have been known to hide costs within the fine print. Title insurance and search. At the end of 2020 the median purchase price in. The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you live according to data from Freddie. Average Cost Of A Mortgage Refinance Closing Costs And Interest Charges Valuepenguin.

Source: pinterest.com

Source: pinterest.com

On average it will cost you more than 750 and thats before taking into account mortgage deregistration fees which vary from state to state but tend to be around 150 on average. Refinancing a home loan can improve a familys monthly cash flow. For Australians looking to take advantage of record-low interest rates and join the unprecedented refinancing boom of 2020 the slight rise in interest rates has created a sense of urgency. You can pay a switching fee of between 250-650 to switch loan products. Sofi Helps Members Save An Average Of 316 Month On Their Student Loans How By Refinancing And Consolida Personal Loans Paying Off Credit Cards Student Loans.

Source: ru.pinterest.com

Source: ru.pinterest.com

Todays average closing costs are likely higher as home values and loan amounts have been increasing across much of the nation. Prepayment Penalty - Some lenders charge a penalty fee if you pay off your home mortgage loan early. Expect to pay 2 3 of your loan balance in closing costs. Thats roughly 282000 in equity on a 414000 home the national average home value. Weighted Average Cost Of Capital Cost Of Capital Weighted Average Accounting And Finance.