However home improvements are treated differently. It is firmly enshrined in US tax lawIf you have to fix a broken floor you cant claim it. Are home repairs tax deductible 2019.

Are Home Repairs Tax Deductible 2019, These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. However home improvements are treated differently. For tax purposes a home improvement includes any work done that substantially adds to the value of your home increases its useful life or adapts it to new uses. Mortgage interest Specifically.

Are Home Improvements Tax Deductible Home Logic From homelogic.co.uk

Are Home Improvements Tax Deductible Home Logic From homelogic.co.uk

The only costs you can deduct are state and local real estate taxes actually paid to the taxing authority and interest that qualifies as home mortgage interest and mortgage insurance premiums. Silas Daji oskaaay Membership. You can not deduct any a part of the price. Can I Get a Tax Deduction for Home Improvements.

The only costs you can deduct are state and local real estate taxes actually paid to the taxing authority and interest that qualifies as home mortgage interest and mortgage insurance premiums.

Read another article:

Are home repairs tax deductible Last Post RSS. These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. A home renovation can be a lucrative tax-deductible investment if you are aware of your tax entitlements. If you use your home purely as your personal residence you cannot. Home repairs are not deductible but home improvements are.

Source: homelogic.co.uk

Source: homelogic.co.uk

Should you use your house purely as your private residence you acquire no tax advantages from repairs. As far as income tax provisions in India is concerned the expenses incurred for home repairs are not specifically deductible but a standard deduction tot he extent of 30 is allowed from the rent received to cover all the expenses incurred including expenses incurred for repairs of the house property under section 24a of the income tax Act 1960. For tax purposes a home improvement includes any work done that substantially adds to the value of your home increases its useful life or adapts it to new usesIf you use your home purely as your personal residence you cannot deduct the cost of home improvementsThese costs are nondeductible personal expenses. Topic starter Are home repairs tax deductible answered below. Are Home Improvements Tax Deductible Home Logic.

Source: stessa.com

Source: stessa.com

For tax purposes a home improvement includes any work done that substantially adds to the value of your home increases its useful life or adapts it to new uses. In other words to be deductible your home office must be your actual office and not just at your home for convenience. Rather the out-of-pocket deductible you must pay before the corporate will cowl any claims relies on a percentage of the insured worth of your homewhich isnt the market worth or the appraised value however the price of changing your private home should it burn to the bottom and. However home improvements are treated differently. Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa.

Source: pinterest.com

Source: pinterest.com

Herein are home repairs tax deductible in 2019. Repairs to a home are not tax deductible. Can I Get a Tax Deduction for Home Improvements. It is firmly enshrined in US tax lawIf you have to fix a broken floor you cant claim it. Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Being A Landlord Business Tax Deductions Business Tax.

Famed Member Admin. Nonetheless house enhancements are handled otherwise. However home improvements are treated differently. You cannot deduct any part of the cost. 6 Tax Deductible Home Improvement Repairs For 2021 Walletgenius.

Source: pinterest.com

Source: pinterest.com

Other examples of improvements or equipment that readily pass irs muster are an elevator or a bathroom on a lower floor that makes things easier for a home owner with arthritis or a heart condition. Equally its requested are house repairs tax deductible in 2019. Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your taxes. As far as income tax provisions in India is concerned the expenses incurred for home repairs are not specifically deductible but a standard deduction tot he extent of 30 is allowed from the rent received to cover all the expenses incurred including expenses incurred for repairs of the house property under section 24a of the income tax Act 1960. The Landlord S Itemized List Of Common Tenant Deposit Deductions Being A Landlord Real Estate Investing Rental Property Rental Property Investment.

Source: houselogic.com

Source: houselogic.com

These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. Equally its requested are house repairs tax deductible in 2019. Although home improvements cannot be deducted they may be depreciated. Are Home Repairs Tax Deductible In 2019This reduces the amount of tax you must pay. Tax Breaks For Capital Improvements On Your Home Houselogic.

Source: homelogic.co.uk

Source: homelogic.co.uk

Topic starter Are home repairs tax deductible answered below. Can I Get a Tax Deduction for Home Improvements. Herein are home repairs tax deductible in 2019. Additionally the price of repairs to that area of your house could be currently tax-deductible. Are Home Improvements Tax Deductible Home Logic.

Source: serviceseeking.com.au

Source: serviceseeking.com.au

Likewise people ask are home repairs tax deductible in 2019. Entrance or exit ramps Bathroom modifications Lowering cabinets Widening doors and hallways Adding handrails. This simply means you deduct the expenditure over a period of time ranging from three to two and a half years. In other words to be deductible your home office must be your actual office and not just at your home for convenience. What Home Improvements Are Tax Deductible.

Source: raynewater.com

Source: raynewater.com

It only makes sense that you should take full advantage of the tax deductions available to you. Are home repairs tax deductible in 2019. Are home repairs tax deductible 2019. For tax purposes a home improvement includes any work done that substantially adds to the value of your home increases its useful life or adapts it to new uses. Are Home Improvements Tax Deductible Rayne Water.

Source: easyhomeimprovement.co.uk

Source: easyhomeimprovement.co.uk

As far as income tax provisions in India is concerned the expenses incurred for home repairs are not specifically deductible but a standard deduction tot he extent of 30 is allowed from the rent received to cover all the expenses incurred including expenses incurred for repairs of the house property under section 24a of the income tax Act 1960. However home improvements are treated differently. Nonetheless house enhancements are handled otherwise. Rather the out-of-pocket deductible you must pay before the corporate will cowl any claims relies on a percentage of the insured worth of your homewhich isnt the market worth or the appraised value however the price of changing your private home should it burn to the bottom and. Which Home Improvements Can Be Part Of Your Tax Deduction Easy Home Improvement Blog.

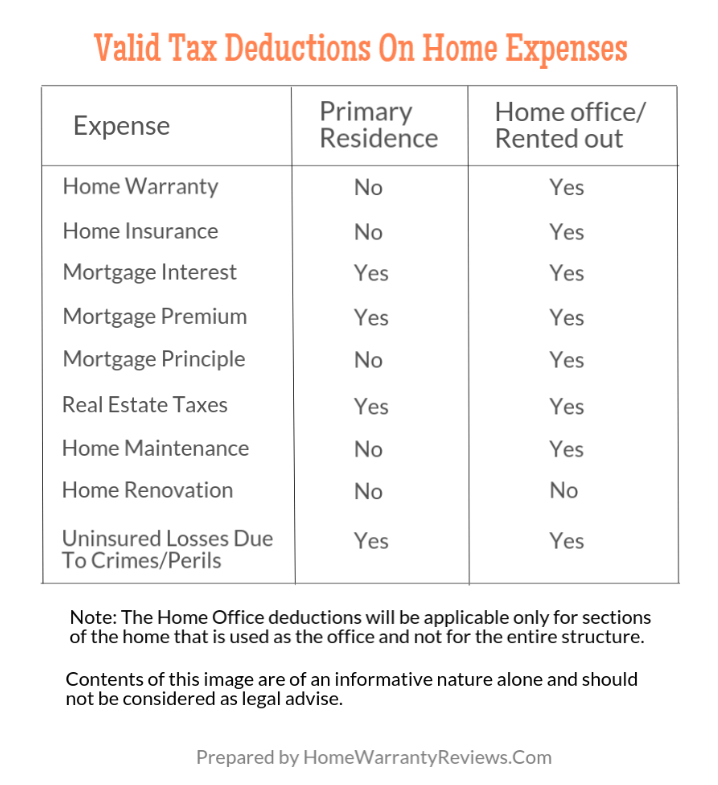

Source: homewarrantyreviews.com

Source: homewarrantyreviews.com

Some Home Repairs May Be Eligible to Be Claimed as Medical Expenses You can deduct them from your income if you are making medically required repairs. Deductible repairs If you might be like most individuals you Google AC restore and begin making calls. Are home repairs tax deductible Last Post RSS. Rather the out-of-pocket deductible you must pay before the corporate will cowl any claims relies on a percentage of the insured worth of your homewhich isnt the market worth or the appraised value however the price of changing your private home should it burn to the bottom and. Are Home Warranty Premiums Tax Deductible.

Source: ownerly.com

Source: ownerly.com

You can not deduct any a part of the price. Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your taxes. When you make a home improvement such as installing central air conditioning or replacing the roof you cant deduct the cost in the year you spend the money. How to Claim Home Improvement Tax Deductions. Are Home Improvements Tax Deductible Ownerly.

Source: americantaxservice.org

Source: americantaxservice.org

However home improvements are treated differently. Your house payment may include several costs of owning a home. Home repairs are not deductible but home improvements are. It is firmly enshrined in US tax lawIf you have to fix a broken floor you cant claim it. What Home Improvements Are Tax Deductible 2021 2022.

Source: walletgenius.com

Source: walletgenius.com

Are home repairs tax deductible Last Post RSS. Equally its requested are house repairs tax deductible in 2019. Although home improvements cannot be deducted they may be depreciated. For tax purposes a home improvement includes any work done that substantially adds to the value of your home increases its useful life or adapts it to new uses. 6 Tax Deductible Home Improvement Repairs For 2021 Walletgenius.

Source: filemytaxesonline.org

Source: filemytaxesonline.org

Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your taxes. A home renovation can be a lucrative tax-deductible investment if you are aware of your tax entitlements. This simply means you deduct the expenditure over a period of time ranging from three to two and a half years. Entrance or exit ramps Bathroom modifications Lowering cabinets Widening doors and hallways Adding handrails. Tax Deductible Home Improvements For Residential Energy Tax Credit.