But with the tax reform brought on by President Trumps Tax Cuts and Jobs Act TCJA a lot of homeowners are struggling to work out whether they can still take a home equity loan tax deduction. Although the tax laws have changed in some cases you can still deduct interest paid on your home equity loan or home equity line of credit HELOC. Are home equity loans tax deductible 2015.

Are Home Equity Loans Tax Deductible 2015, Most major news sources were reporting the same. Before you decide to take out a home equity loan its smart to know whether the interest might be tax deductible. As an example and according to the IRS interest paid on a home equity loan or HELOC that was used to buy build or substantially improve the residence that secures the loan is tax deductible. If you borrow in the form of a personal loan.

Pin By Melissa Miller On Books Worth Reading Budgeting Budgeting Money Money Saving Tips From pinterest.com

Pin By Melissa Miller On Books Worth Reading Budgeting Budgeting Money Money Saving Tips From pinterest.com

Are Home Equity Loans Tax Deductible. Mortgage interest tax deductions are extended to second mortgages too. You get a home acquisition loan to build buy or improve a home. Interest on home equity loans has traditionally been fully tax-deductible.

Thats good news for homeowners looking for a low-interest way to renovate a home.

Read another article:

The answer is you can still deduct home equity loan interest. But with the tax reform brought on by President Trumps Tax Cuts and Jobs Act TCJA a lot of homeowners are struggling to work out whether they can still take a home equity loan tax deduction. If youre looking for a loan to renovate your home or pay down another debt you might have an opportunity to use the equity youve already invested in your home. Even if the home equity loan was taken out before the law was changed if it was used for a purpose other than to buy build or improve your home it is not deductible. Interest paid on a refinance loan home equity loans HELOAN and home equity lines of credit HELOC are tax-deductible as.

Source: pinterest.com

Source: pinterest.com

In it the IRS stated that the interest on home equity loans HELOCs and second mortgages is still tax-deductible regardless of how the loan is labeled if the funds are used to buy build or substantially improve the taxpayers home that secures the loan. The biggest advantage of this form of borrowing is that the interest on the same is tax deductible. The answer is you can still deduct home equity loan interest. Despite new provisions in the Tax Cut and Jobs Act the IRS in a 2018 advisory memo stated that home equity loan interest may still be deductible along with interest on HELOCs and second mortgages. Partner Xchange Build Credit Easy Step Credit Score.

Source: in.pinterest.com

Source: in.pinterest.com

Not all home equity loan interest is deductible The IRS allows interest deductions on up to 750000 or 1 million in mortgage debt depending on when the loan originated and whether youre filing. And the more we know about them as adults the easier our finances become. Thats good news for homeowners looking for a low-interest way to renovate a home. Beginning in 2018 taxpayers may only deduct interest on 750000 of qualified residence loans. Loan Info Va Mortgage Loans Refinancing Mortgage Refinance Loans.

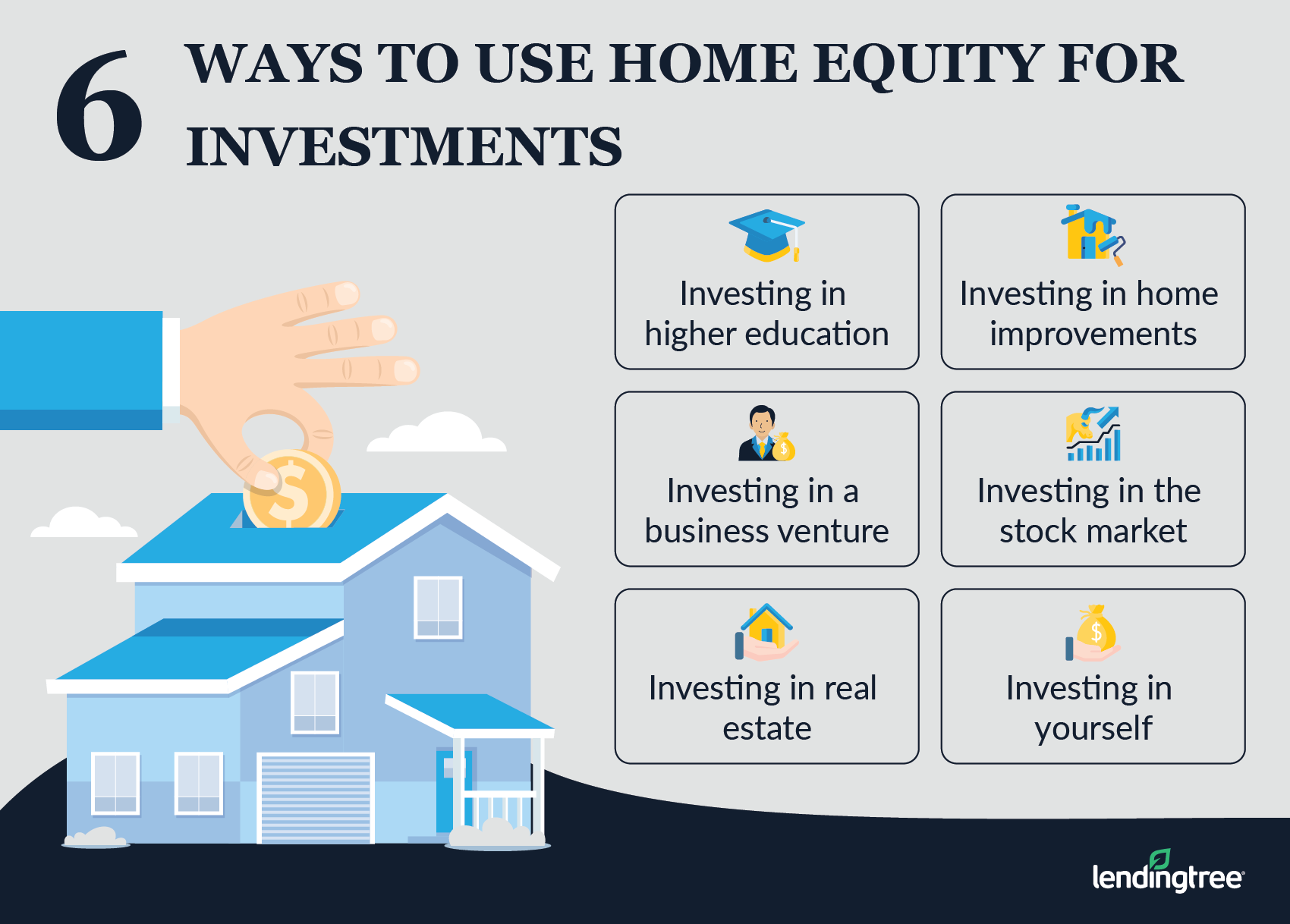

Source: lendingtree.com

Source: lendingtree.com

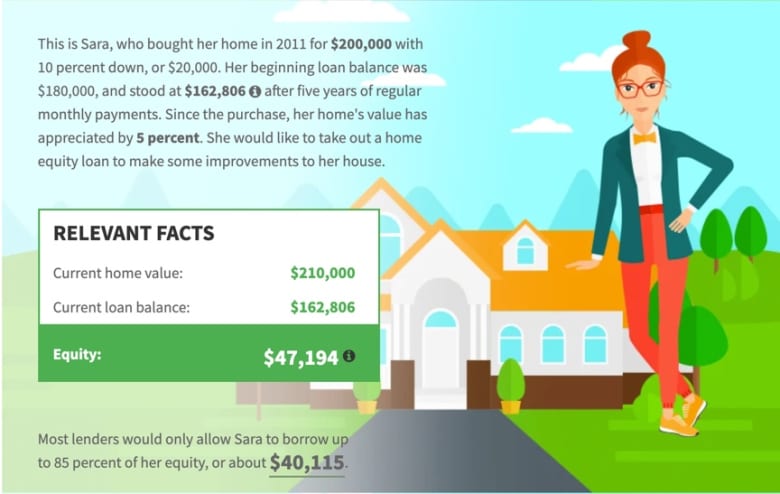

However if the taxpayer used the home equity loan proceeds for personal expenses such as paying off student loans and credit cards then the interest on the home equity loan would not be deductible. In tax years 2018 until 2026 home equity loan interest is only deductible if you use the loan proceeds to buy build or substantially improve the home that secures the loan. Are Home Equity Loans Tax Deductible. Buy a primary residence or second home using a home equity loan. Can You Use Home Equity To Invest Lendingtree.

Source: debt.org

Source: debt.org

Before you decide to take out a home equity loan its smart to know whether the interest might be tax deductible. Interest on home equity loans has traditionally been fully tax-deductible. Previously we wrote that home equity loans in New Jersey and nationwide would no longer be tax-deductible thanks to the new legislation signed into law on December 22. 25042020 under the tax cuts and jobs act homeowners who are married filing jointly can deduct mortgage interest on up to 750000 worth of loans. Home Equity Loans Pros And Cons Minimums And How To Qualify.

Source: de.pinterest.com

Source: de.pinterest.com

Although the tax laws have changed in some cases you can still deduct interest paid on your home equity loan or home equity line of credit HELOC. Under these rules you could potentially deduct home equity loan interest up to the maximum limits if you. Despite new provisions in the Tax Cut and Jobs Act the IRS in a 2018 advisory memo stated that home equity loan interest may still be deductible along with interest on HELOCs and second mortgages. Build a primary residence or second home using a home equity loan. Best Mortgage Agent In Brampton In 2020.

Source: br.pinterest.com

Source: br.pinterest.com

Buy a primary residence or second home using a home equity loan. Heres a quick example. Beginning in 2018 taxpayers may only deduct interest on 750000 of qualified residence loans. Make home improvements to your current primary residence or second home using a home equity loan. Who Pays U S Income Tax And How Much Pew Research Center Income Tax Federal Income Tax Sociology Articles.

Source: pinterest.com

Source: pinterest.com

Interest paid on a refinance loan home equity loans HELOAN and home equity lines of credit HELOC are tax-deductible as. Under these rules you could potentially deduct home equity loan interest up to the maximum limits if you. And the more we know about them as adults the easier our finances become. However if the taxpayer used the home equity loan proceeds for personal expenses such as paying off student loans and credit cards then the interest on the home equity loan would not be deductible. What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage.

Source: in.pinterest.com

Source: in.pinterest.com

2 this means that you could take the mortgage interest deduction for a home equity loan you use to add a room to your home but cant take it if. If you borrow in the form of a personal loan. 25042020 under the tax cuts and jobs act homeowners who are married filing jointly can deduct mortgage interest on up to 750000 worth of loans. Several other tax changes directly affect taxpayers who own a home or plan to purchase one including reduction of the limit on Deductible mortgage debt to 750 000 for loans taken out after Dec. What Does A Mortgage Pre Approval Letter Look Like Preapproved Mortgage Lettering Fha Streamline Refinance.

Source: pinterest.com

Source: pinterest.com

The IRS clearly states that home equity loans used for home improvements would result in the deductibility of interest on those loans. Despite new provisions in the Tax Cut and Jobs Act the IRS in a 2018 advisory memo stated that home equity loan interest may still be deductible along with interest on HELOCs and second mortgages. A home equity loan is a financial product that. If youre looking for a loan to renovate your home or pay down another debt you might have an opportunity to use the equity youve already invested in your home. Iphone Screenshot 4 Credit Card App Mobile Credit Card Free Gift Cards Online.

Source: pinterest.com

Source: pinterest.com

Theres been a lot of confusion surrounding the home equity line of credit or HELOC section of the Tax Cuts and Jobs Act. Thats good news for homeowners looking for a low-interest way to renovate a home. Several other tax changes directly affect taxpayers who own a home or plan to purchase one including reduction of the limit on Deductible mortgage debt to 750 000 for loans taken out after Dec. However if the taxpayer used the home equity loan proceeds for personal expenses such as paying off student loans and credit cards then the interest on the home equity loan would not be deductible. Pin By Melissa Miller On Books Worth Reading Budgeting Budgeting Money Money Saving Tips.

Source: pinterest.com

Source: pinterest.com

Mortgage interest tax deductions are extended to second mortgages too. Although the tax laws have changed in some cases you can still deduct interest paid on your home equity loan or home equity line of credit HELOC. Lets say that you bought a home in 2015 worth 900000 and took out a mortgage worth 800000. You get a home acquisition loan to build buy or improve a home. 2013 Property Market Home Loan Interest Rates Market Update Ocean Home Loans Home Renovation Loan Home Improvement Loans Home Loans.

Source: thebalance.com

Source: thebalance.com

Several other tax changes directly affect taxpayers who own a home or plan to purchase one including reduction of the limit on Deductible mortgage debt to 750 000 for loans taken out after Dec. If youre looking for a loan to renovate your home or pay down another debt you might have an opportunity to use the equity youve already invested in your home. In it the IRS stated that the interest on home equity loans HELOCs and second mortgages is still tax-deductible regardless of how the loan is labeled if the funds are used to buy build or substantially improve the taxpayers home that secures the loan. Under these rules you could potentially deduct home equity loan interest up to the maximum limits if you. Home Equity Loans The Pros And Cons And How To Get One.

Source: nl.pinterest.com

Source: nl.pinterest.com

That would include using the loan to pay down other debt. The IRS clearly states that home equity loans used for home improvements would result in the deductibility of interest on those loans. Heres a quick example. Make home improvements to your current primary residence or second home using a home equity loan. Publication 970 2014 Tax Benefits For Education Education College Info Progress Report.

Source: in.pinterest.com

Source: in.pinterest.com

If youre looking for a loan to renovate your home or pay down another debt you might have an opportunity to use the equity youve already invested in your home. The IRS last week clarified that interest paid on home equity loans is still deductible in most cases following the passage of federal tax reform. In other words the interest on these loans would be deductible on Schedule A under mortage interest along with the. The IRS clearly states that home equity loans used for home improvements would result in the deductibility of interest on those loans. Reverse Mortgage The Right Choice Tumortgage Home Equity Loan Home Equity Reverse Mortgage.

Source: moneygeek.com

Source: moneygeek.com

The IRS last week clarified that interest paid on home equity loans is still deductible in most cases following the passage of federal tax reform. Interest on home equity loans is tax deductible depending on how the loan was spent your total mortgage debt and if you itemize your deductions. 2 this means that you could take the mortgage interest deduction for a home equity loan you use to add a room to your home but cant take it if. But with the tax reform brought on by President Trumps Tax Cuts and Jobs Act TCJA a lot of homeowners are struggling to work out whether they can still take a home equity loan tax deduction. Guide To Home Equity Loans Pros Cons Requirements Limits Moneygeek Com.