The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage. Watch are home equity lines of credit considered residential mortgage loans Video. Are home equity lines of credit considered residential mortgage loans.

Are Home Equity Lines Of Credit Considered Residential Mortgage Loans, As with any other loan. Line Of Credit A line of credit LOC mortgage allows you to use the loan as your cheque account so you can draw down and repay the loan as you choose. Equity is the value of your home minus any money you owe on it. Both offer lower interest rates and longer repayment tenures of up to 15 years.

Car And Auto Title Loans Artesia Ca 951 226 5874 Https Www 10waystogetridof Com Car And Auto Title Loans Artesia Finance Loans Loan Lenders Refinance Loans From za.pinterest.com

Car And Auto Title Loans Artesia Ca 951 226 5874 Https Www 10waystogetridof Com Car And Auto Title Loans Artesia Finance Loans Loan Lenders Refinance Loans From za.pinterest.com

The interest rates are lower than they would be with a credit card. First the funds you receive through a home equity loan or home equity line of credit HELOC are not taxable as income - its borrowed money not an increase your earnings. A borrower might use a HELOC to pay for his familys vacation or. Snagging a tax deduction for the interest you pay is an added perk.

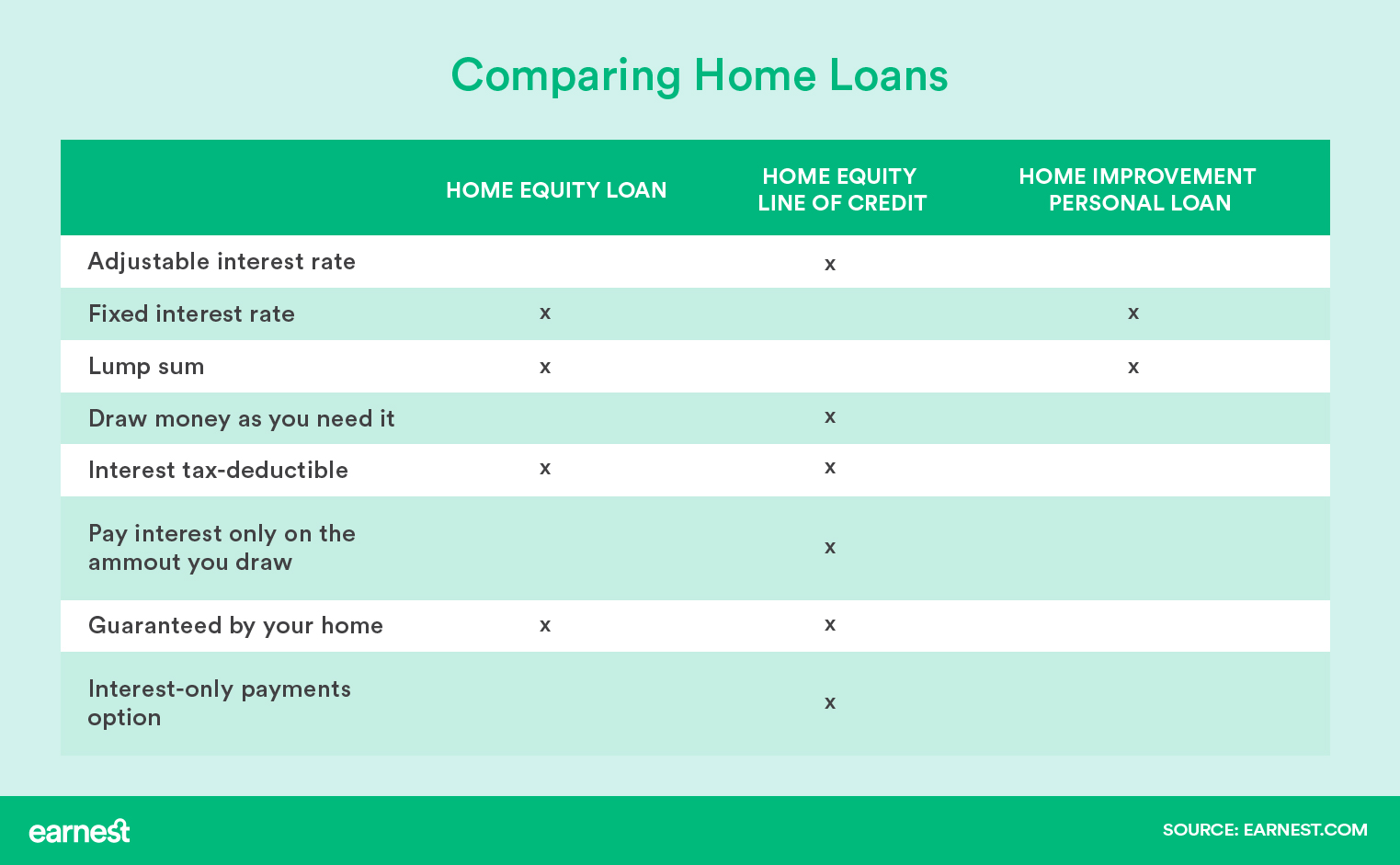

A second loan or mortgage against your house will either be a home equity loan which is a lump-sum loan with a fixed term and rate or a HELOC which features variable rates and continuing access to funds.

Read another article:

Home equity lines of credit are sometimes considered to be a form of second mortgage because both are secured behind another lender that already has the first loan for which your house acts as collateral. Residential mortgages financing to buy or build a home that is secured by the home mortgage refinances home equity loans or lines of credit or reverse mortgages. Often used to finance a major purchase like remodeling your home or purchasing a new. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage. Line of Credit LOC - A Home Loan with Flexibility and Choice.

Source: pinterest.com

Source: pinterest.com

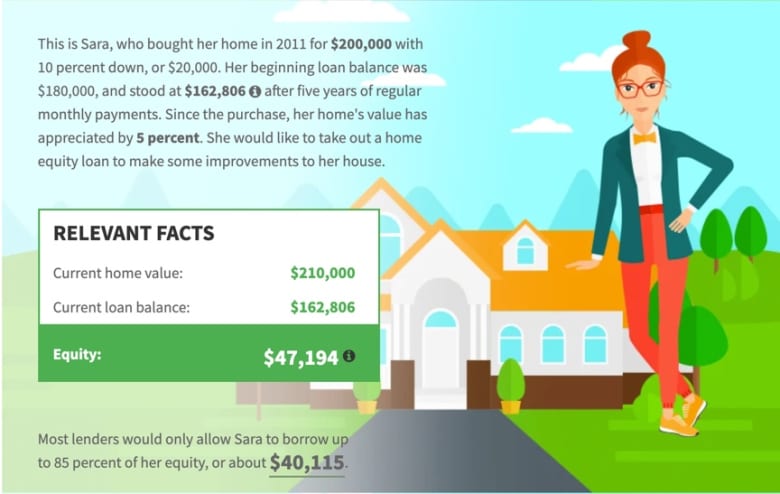

Equity is the value of your home minus any money you owe on it. Often used to finance a major purchase like remodeling your home or purchasing a new. If you have a 250000 home youd need at least 30 equitya mortgage loan balance of no more than 175000in order to qualify for a 25000 home equity loan or line of credit. Both offer lower interest rates and longer repayment tenures of up to 15 years. Funding Your Dreams With A Home Equity Loan Estate Lawyer Home Mortgage Homeowners Insurance.

Source: pinterest.com

Source: pinterest.com

If you have a 250000 home youd need at least 30 equitya mortgage loan balance of no more than 175000in order to qualify for a 25000 home equity loan or line of credit. Both offer lower interest rates and longer repayment tenures of up to 15 years. Home equity loans and lines of credit can be useful for major home renovations major life expenses and debt consolidation thanks to the flexibility and low rates they offer. A home equity line of credit HELOC and a home equity loan are both additional loans placed against your property or home. 2013 Property Market Home Loan Interest Rates Market Update Ocean Home Loans Home Renovation Loan Home Improvement Loans Home Loans.

Source: earnest.com

Source: earnest.com

The percentage you can borrow via a home equity loan varies depends on how much of the home you own outright. Typically separate from your main mortgage it allows you to borrow some or all of the equity in your home. 1 such as credit cards. A lender takes a legal charge over your home as security for the facility and you can then withdraw cash up to your pre-agreed limit as and when you need it. Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest.

Source: investopedia.com

Source: investopedia.com

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65 of your homes purchase price or market value. Most HELOC lenders will want 700 ficos but some niche 2nd mortgage lenders will accept credit scores between 620 and 680 if you have some equity and a low debt to income ratio. Home equity lines of credit or HELOCs are lines of credit secured by your home that can be used for large expenses or to consolidate higher-interest rate debt on other loans. Snagging a tax deduction for the interest you pay is an added perk. Home Equity Loan Definition.

Source: moneygeek.com

Source: moneygeek.com

With a home equity loan the lender advances you the total loan amount upfront while a home equity credit line provides a source of funds that you can draw on as needed. With a home equity loan the lender advances you the total loan amount upfront while a home equity credit line provides a source of funds that you can draw on as needed. Most HELOC lenders will want 700 ficos but some niche 2nd mortgage lenders will accept credit scores between 620 and 680 if you have some equity and a low debt to income ratio. Second in some areas you may have to pay a mortgage recording tax. Guide To Home Equity Loans Pros Cons Requirements Limits Moneygeek Com.

Source: pinterest.com

Source: pinterest.com

Unlike traditional mortgage products a home equity line of credit may be paid off and used again without the lenders approval. That means youll need to own more than 20 of your home before you can even qualify for a home equity loan. A home equity line of credit is a credit facility that is secured on your property. The percentage you can borrow via a home equity loan varies depends on how much of the home you own outright. It Is Always In Your Dream To Build Your Own Home But Cant Make It In Reality Mortgage Refinance Mortgag Build Your Own House Home Loans Refinance Mortgage.

Source: rocketmortgage.com

Source: rocketmortgage.com

Home equity lines of credit or HELOCs are lines of credit secured by your home that can be used for large expenses or to consolidate higher-interest rate debt on other loans. A home equity line of credit is a credit facility that is secured on your property. You can also use the line of credit to carry out renovations pay your bills or invest in shares. Equity is the value of your home minus any money you owe on it. Home Equity Line Of Credit Heloc Rocket Mortgage.

Source: pinterest.com

Source: pinterest.com

A home equity line of credit is a credit facility that is secured on your property. Residential mortgages financing to buy or build a home that is secured by the home mortgage refinances home equity loans or lines of credit or reverse mortgages. This means that the bank will approve to borrow up to a certain amount of your home but your equity in the home stands as collateral for the loan. Line of Credit LOC - A Home Loan with Flexibility and Choice. Applying For Loans For People On Dss Is Very Easy Simple And Hassle Free All You Will Need To Do Through Online To Home Buying Rental Property Home Mortgage.

Source: pinterest.com

Source: pinterest.com

Mortgage loans and Home Equity loans are two different types of loans you can take by pledging your property. However due to the increased expense associated with originating home equity products and their relatively low rates these loans usually entail closing costs. A home equity line of credit HELOC and a home equity loan are both additional loans placed against your property or home. Mortgage loans and Home Equity loans are two different types of loans you can take by pledging your property. Home Equity Loan Home Equity Loan Payday Loans Mortgage Lenders.

Source: pinterest.com

Source: pinterest.com

Home equity loan Similar to a mortgage or consumer loan a home equity loan is one lump sum to be paid back in regular payments over a specified term. Home equity loans and Home Equity Lines of Credit HELOCs are first or second deeds of trust available on residential property. The following example is for illustration purposes only. If your home is worth 500000 and you owe 200000 on your mortgage then your equity is 300000. Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable And Home Loans Mortgage Checklist Business Loans.

Source: pinterest.com

Source: pinterest.com

You and the lender agree to a maximum you can borrow an interest rate on the loan and a term. The following example is for illustration purposes only. A lender takes a legal charge over your home as security for the facility and you can then withdraw cash up to your pre-agreed limit as and when you need it. Based on the date the interest rate is set locked or re-locked lenders must compare their APR with the Feds APOR index. Tumblr Usda Loan Home Loans Usda.

Source: lendingtree.com

Source: lendingtree.com

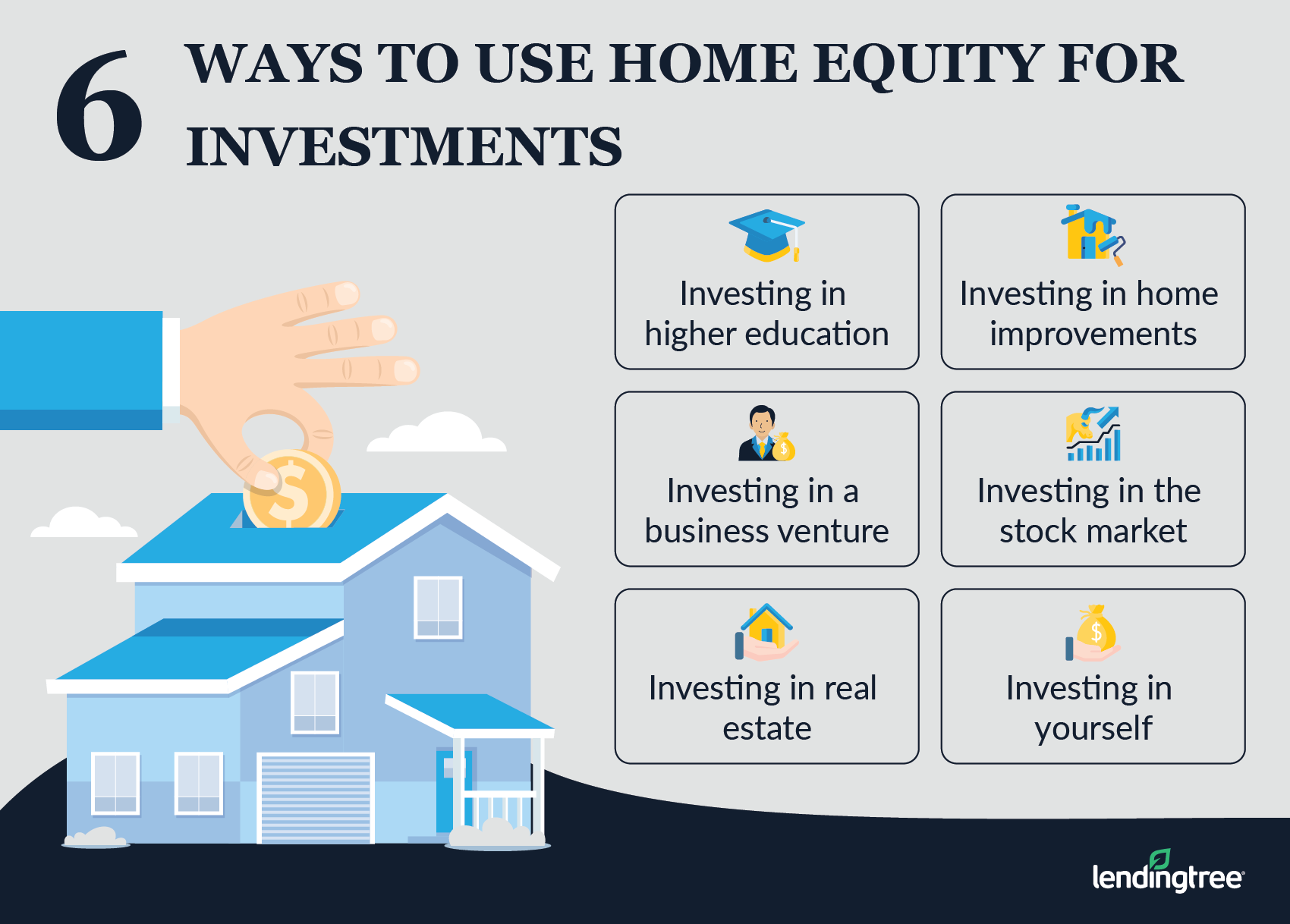

A home equity loan or HELOC can be a convenient source of funding when you want to spruce up your home. The percentage you can borrow via a home equity loan varies depends on how much of the home you own outright. Home equity loans and Home Equity Lines of Credit HELOCs are first or second deeds of trust available on residential property. Unlike traditional mortgage products a home equity line of credit may be paid off and used again without the lenders approval. Can You Use Home Equity To Invest Lendingtree.

Source: pinterest.com

Source: pinterest.com

A lender takes a legal charge over your home as security for the facility and you can then withdraw cash up to your pre-agreed limit as and when you need it. Unlike traditional mortgage products a home equity line of credit may be paid off and used again without the lenders approval. Typically separate from your main mortgage it allows you to borrow some or all of the equity in your home. This means that the bank will approve to borrow up to a certain amount of your home but your equity in the home stands as collateral for the loan. Go Online And Get 100 Ltv Home Equity Loan With Bad Credit Quickly Qualify With Simple And Secure Process Fo Home Equity Loan Loans For Bad Credit Home Equity.

Source: pinterest.com

Source: pinterest.com

Equity is the value of your home minus any money you owe on it. Snagging a tax deduction for the interest you pay is an added perk. Watch are home equity lines of credit considered residential mortgage loans Video. When considering a home equity loan or credit line shop around and compare loan plans offered by banks savings and loans credit unions and mortgage companies. Heloc Payment Calculator With Interest Only And Pi Calculations Home Improvement Loans Home Equity Loan Home Loans.

Source: pinterest.com

Source: pinterest.com

A lender takes a legal charge over your home as security for the facility and you can then withdraw cash up to your pre-agreed limit as and when you need it. A second loan or mortgage against your house will either be a home equity loan which is a lump-sum loan with a fixed term and rate or a HELOC which features variable rates and continuing access to funds. The following example is for illustration purposes only. A borrower might use a HELOC to pay for his familys vacation or. Simple Reverse Mortgage Guide Mls Reverse Mortgage Reverse Mortgage Amortization Schedule Mortgage Amortization Calculator.