ANZ Flexible Home Loan Fees Monthly account fee - 1250 Unarranged overdraft fee - 3 Applies if we choose to let you make payments or withdrawals or take any fees or charges when you dont have enough money in your account. ANZ acknowledges that many of its customers are searching for greater repayment certainty in the current environment and so are offering a lower fixed rate to. Anz bank variable home loan rates.

Anz Bank Variable Home Loan Rates, Rates from 244 Finder Home Home Loans Advertiser disclosure ANZ home loans ANZ has home loans for owner-occupiers and investors with rates starting from 244. ANZ today announced it will decrease variable interest home loan rates in Australia by 025pa following the Reserve Bank of Australias decision to reduce the official cash rate. ANZ has announced new fixed rates for owner occupiers paying principal and interest to become effective on 5 November 2020. Rate decision 4 November 2020.

Anz Smsf Cash Hub Account Finder From finder.com.au

Anz Smsf Cash Hub Account Finder From finder.com.au

5 on owner occupied home loan under the ANZ Breakfree package. To support home owners ANZ will decrease its fixed home loan rates across one to five-year terms by between 020pa - 040pa for owner occupier customers paying principal and interest on ANZs Breakfree package providing its lowest fixed rates on record. ANZ Home Loans. Were lending you money you dont have and you must repay that money as soon as possible or when we ask.

Cutting its 2-year fixed home loan rate by 049 per cent for owner occupiers paying principal and interest.

Read another article:

Looking to buy or refinance your home. ANZ Bank New Zealand ANZ NZ today announced it will pass on the full 075 Official Cash Rate cut by the Reserve Bank of New Zealand RBNZ to its Floating and Flexi home loans rates. 6 Annual fee 395. VIEW PROFILE ANZ Bank followed ASB as the first major banks to increase variable home loan rates after the Reserve Bank announced it would increase the. Use our calculator and comparison tools to explore our home loan and repayments options.

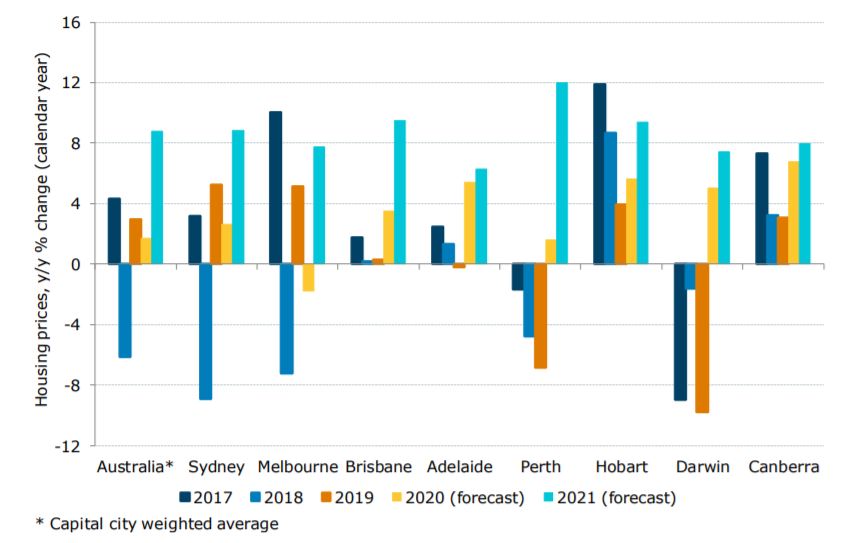

ANZ has become the latest lender to cut its basic variable rate by up to 043 percent for owner-occupiers paying principal and interest. Get a loan term of 1 to 7 years. Whether you are looking to buy build or renovate we can help you achieve your home ownership goals. Take advantage of our great interest rate of 679 pa. Anz House Prices To Rise 9 In 2021.

ANZ the only big four bank to cut variable rates for existing customers. Enjoy the flexibility of an ANZ Variable Rate Personal Loan which may help you take control and reach your goals. Investment loan interest rate 2 year fixed interest rate with discounted rate when borrowing 80 or less of the property value 5 on an ANZ Fixed Residential Investment Loan under the ANZ Breakfree package. ANZ home loans with variable and fixed rate options available. Grant Alday Grantmyall Twitter.

![]() Source: mozo.com.au

Source: mozo.com.au

The main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan. To support home owners ANZ will decrease its fixed home loan rates across one to five-year terms by between 020pa - 040pa for owner occupier customers paying principal and interest on ANZs Breakfree package providing its lowest fixed rates on record. Today ANZ joined 25 other lenders by cutting its basic variable rate by up to 043 per cent for owner-occupiers paying principal and interest. For Standard Variable Rate Owner Occupiers paying Principal Interest the Index Rate will reduce by 014pa to 479pa. What S A Tracker Mortgage Rate Tracker Home Loans Explained Mozo.

Source: mortgagebusiness.com.au

Source: mortgagebusiness.com.au

Plus if you take out an ANZ Variable Rate Home Loan by 31 January 2022 youll pay no Loan Approval Fee. This means your repayments decrease when interest rates go down and your repayments will increase when interest rates go up. ANZ decreases variable home loan rates. ANZ has become the latest lender to cut its basic variable rate by up to 043 percent for owner-occupiers paying principal and interest. Anz Westpac Drop Variable Mortgage Rates Mortgage Business.

For Standard Variable Rate Owner Occupiers paying Principal Interest the Index Rate will reduce by 014pa to 479pa. ANZ today announced it will decrease variable interest home loan rates in Australia by 025pa following the Reserve Bank of Australias decision to reduce the official cash rate. Plus if you hold ANZ Asset Protector home insurance 1 on 9 March 2022 youll also go in the draw to win one of five prizes of a 1000 credit to go towards your insurance. ANZ Bank New Zealand ANZ NZ today announced it will pass on the full 075 Official Cash Rate cut by the Reserve Bank of New Zealand RBNZ to its Floating and Flexi home loans rates. 2.

Home loan rate changes. ANZ has announced new fixed rates for owner occupiers paying principal and interest to become effective on 5 November 2020. For ANZ owner occupiers the standard variable home loan rate will increase to 536 percent per annum for customers with principal and interest repayments and 591 percent per annum for customers with interest only repayments. Both will be effective from 11 November. If Someone Comes To Me With A Good Deposit And Wants To Buy Themselves A Home I M Not Going To Turn Them Away Interest Co Nz.

Source: savings.com.au

Source: savings.com.au

Get a loan term of 1 to 7 years. ANZ Bank New Zealand ANZ NZ today announced it will pass on the full 075 Official Cash Rate cut by the Reserve Bank of New Zealand RBNZ to its Floating and Flexi home loans rates. If you have an eligible ANZ Home Loan on 9 March 2022 youll go in the draw to win up to 100000 off the outstanding balance to help pay off your home loan faster. 5 on owner occupied home loan under the ANZ Breakfree package. Home Loan News Bank Of Us Matches Low Rate Home Loan Offer.

ANZ today announced it will decrease variable interest home loan rates in Australia by 018pa following the Reserve Bank of Australias decision to reduce the official cash rate. ANZ acknowledges that many of its customers are searching for greater repayment certainty in the current environment and so are offering a lower fixed rate to. Plus if you take out an ANZ Variable Rate Home Loan by 31 January 2022 youll pay no Loan Approval Fee. The main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan. Anz House Prices To Rise 9 In 2021.

Source: pinterest.com

Source: pinterest.com

ANZ has become the latest lender to cut its basic variable rate by up to 043 percent for owner-occupiers paying principal and interest. Were lending you money you dont have and you must repay that money as soon as possible or when we ask. Enjoy the flexibility of an ANZ Variable Rate Personal Loan which may help you take control and reach your goals. ANZ has become the latest lender to cut its basic variable rate by up to 043 percent for owner-occupiers paying principal and interest. Pin On Semiotics June 2019.

Source: mozo.com.au

Source: mozo.com.au

Home loan rate changes. ANZ home loans with variable and fixed rate options available. 5 on owner occupied home loan under the ANZ Breakfree package. VIEW PROFILE ANZ Bank followed ASB as the first major banks to increase variable home loan rates after the Reserve Bank announced it would increase the. Anz Leads Big Banks On Low Personal Loan Rates.

Source: thenewdaily.com.au

Source: thenewdaily.com.au

Apply to borrow between 5000 and 50000. Anz Bank Variable Home Loan Rate It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. 5 on owner occupied home loan under the ANZ Breakfree package. The main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan. What A String Of Cuts To Home Loan Rates Means For The Rba S Rate Speech.

Source: murrayhomeloans.com.au

Source: murrayhomeloans.com.au

6 Annual fee 395. ANZ has announced new fixed rates for owner occupiers paying principal and interest to become effective on 5 November 2020. Use our calculator and comparison tools to explore our home loan and repayments options. ANZ has become the latest lender to cut its basic variable rate by up to 043 percent for owner-occupiers paying principal and interest. Understanding Interest Rates Murray Home Loans.

Source: businessinsider.com.au

Source: businessinsider.com.au

Use our calculator and comparison tools to explore our home loan and repayments options. The Floating home loan rate will drop from 519 to 444 while the Flexi rate will drop from 530 to 455. Richard Whitten Updated Aug 6 2021. This means your repayments decrease when interest rates go down and your repayments will increase when interest rates go up. Mortgages V Official Cash Rates How Australia S Banks Are Taking A Bigger Share In One Chart.

Source: finder.com.au

Source: finder.com.au

VIEW PROFILE ANZ Bank followed ASB as the first major banks to increase variable home loan rates after the Reserve Bank announced it would increase the. ANZ the only big four bank to cut variable rates for existing customers. For ANZ owner occupiers the standard variable home loan rate will increase to 536 percent per annum for customers with principal and interest repayments and 591 percent per annum for customers with interest only repayments. If you have an eligible ANZ Home Loan on 9 March 2022 youll go in the draw to win up to 100000 off the outstanding balance to help pay off your home loan faster. Anz Smsf Cash Hub Account Finder.

Source: mozo.com.au

Source: mozo.com.au

A variable home loan means the interest rate that is applied to your home loan can change for example due to changes in the economy. ANZ Flexible Home Loan Fees Monthly account fee - 1250 Unarranged overdraft fee - 3 Applies if we choose to let you make payments or withdrawals or take any fees or charges when you dont have enough money in your account. The bank led by Shayne Elliott moved on Monday to slice its basic variable home loan rate by up to 043 per cent for owner occupiers paying principal and interest. For Standard Variable Rate Owner Occupiers paying Principal Interest the Index Rate will reduce by 014pa to 479pa. Anz Leads Big Banks On Low Personal Loan Rates.