Loan eligibility is assessed according to profile work stability experience and up to 80 of property value. Aadhar Housing Finance Ltd Home Loan amount depends on applicants incomesalary because as per policy a person can pay 50 to 60 depends on bank to bank total amount of monthly income in the form of EMIs. Aadhar home loan eligibility.

Aadhar Home Loan Eligibility, Loan eligibility is assessed according to profile work stability experience and up to 80 of property value. The calculation is done on the basis of a few basic details like gross monthly income loan tenure loan interest rate and on-going loan payments. After assessing the requirements of the individual their repayment capacity and other factors the actual loan amount is decided. Eligibility Criteria Applicants between 21 and 60 years of age Credit Score should be 750 or above Minimum work experience of 2 years and minimum of 1 year with the current company Net monthly salary of Rs.

Home Loan Offer At Antworksmoney Home Loans Loan Loan Interest Rates From in.pinterest.com

Home Loan Offer At Antworksmoney Home Loans Loan Loan Interest Rates From in.pinterest.com

Use Aadhar Housing Finance Home Loan Eligibility Calculator to instantly assess home loan eligibility. You can avail of an Aadhar Home Loan up to 1 Crore. Loan Amount You can apply for any amount starting from Rs 25000- to Rs 500000-. Loan eligibility is assessed according to profile work stability experience and up to 80 of property value.

Home Loan Interest Rates Charges.

Read another article:

Know your home loan eligibility with Aadhar Housing Finance Ltd AHFL eligibility calculator. Check Your Eligibility for Aadhar Housing Finance Home Loan The eligibility criteria is subject to change from one profession to another is as follows. The eligibility criteria are as follows. Salaried persons All salaried employees including 3 rd or 4 th grade employees in Private firms or Government departments such as police defence municipality and so on. Applicant should Have Aadhar Card on which heshe want to take loan.

Source: in.pinterest.com

Source: in.pinterest.com

Eligibility Criteria of Aadhar Card Loan Scheme. Aadhar Housing Finance Home Loan Eligibility Calculator. Loan Amount You can apply for any amount starting from Rs 25000- to Rs 500000-. The minimum age of the applicant should be at least 24 years. Enjoy 10 Higher Loan Eligibility With Antworks Money Home Loan Home Loans Loan Interest Rates.

Source: in.pinterest.com

Source: in.pinterest.com

To Get the benefit of this scheme Applicant should have above 18 Years. Home Loan Eligibility Documents. All Indian citizens are eligible to apply for an Aadhaar card. Eligibility for a personal loan using an Aadhar card To prevent repayment of loan defaults the lender provides eligibility criteria for the individuals before applying for a personal loan. Home Loan Offer At Antworksmoney Home Loans Loan Loan Interest Rates.

Source: bankbazaar.com

Source: bankbazaar.com

The age of the applicant should be above 18 years. Our financing process is simple hassle-free transparent and speedy. The minimum age of the applicant should be at least 24 years. Searching For Aadhar Home Loan Eligibility Auction Com Home Loan Letter Of Recommendation For Mortgage Loan Lloyds Svr Mortgage Rates Loan On Home Mortgage Lic Of India Home Loan Lexington Mortgage Corporation Making Extra Payments To Mortgage Principal Macquarie Home Loans Contact Lloyds Mortgage Application Local Home Loan Lenders. Home Loan Process In 2021 Simplified Home Loan Application Process.

Source: livemint.com

Source: livemint.com

To Get the benefit of this scheme Applicant should have above 18 Years. Eligibility Criteria Applicants between 21 and 60 years of age Credit Score should be 750 or above Minimum work experience of 2 years and minimum of 1 year with the current company Net monthly salary of Rs. Home Loan for self. For Salaried Applicants Maximum loan amount Eligibility Upto 80 of the property value Maximum loan tenure Upto 20 Years or the retirement age of 60 years whichever is earlier. Checklist Of Documents Required For A Home Loan.

Source: kotak.com

Source: kotak.com

Age Educational background Stability and Continuity of income Number of dependents in the Family. The eligibility criteria are as follows. Eligibility Criteria of Aadhar Card Loan Scheme. The monthly salary eligibility to avail of the scheme starts at 5000 per month. Home Loan Eligibility Check Your Housing Loan Eligibility Online Kotak Mahindra Bank.

Source: financialexpress.com

Source: financialexpress.com

NRIs Non-Resident Indians who have lived in the country for a continuous period of 182 days are permitted to apply. Eligibility Criteria of Aadhar Card Loan Scheme. Loan under this scheme can be availed by the salaried self employed individuals police and defense savvy railway employee third and fourth grade of government employee. Applicant should Have Aadhar Card on which heshe want to take loan. Tips To Check Your Home Loan Eligibility With Co Applicant Existing Loan And Credit Score The Financial Express.

Source: financialexpress.com

Source: financialexpress.com

The borrowers age during the tenure should be between 18 to 60 years for salaried 18 to 70 years for self-employed. Aadhar Housing Finance Home Loan Eligibility Calculator. As far as eligibility criteria are concern income must be between INR 5000 and INR 50000. Applicant should have all necessary documents like Pan Card Address Proof Income Proof and. 5 Things To Know Before Going To A Lender For A Home Loan The Financial Express.

Source: in.pinterest.com

Source: in.pinterest.com

The maximum age of the applicant can be 65 years in case of self- employed. NRIs Non-Resident Indians who have lived in the country for a continuous period of 182 days are permitted to apply. To Get the benefit of this scheme Applicant should have above 18 Years. The age of the applicant should be above 18 years. Pin By Ifl Housing Finance On Home Loan Home Loans Best Home Loans Renting A House.

Source: in.pinterest.com

Source: in.pinterest.com

Aadhar Housing Finance Ltd Home Loan amount depends on applicants incomesalary because as per policy a person can pay 50 to 60 depends on bank to bank total amount of monthly income in the form of EMIs. Searching For Aadhar Home Loan Eligibility Auction Com Home Loan Letter Of Recommendation For Mortgage Loan Lloyds Svr Mortgage Rates Loan On Home Mortgage Lic Of India Home Loan Lexington Mortgage Corporation Making Extra Payments To Mortgage Principal Macquarie Home Loans Contact Lloyds Mortgage Application Local Home Loan Lenders. Here are a few more factors that are considered. Use Aadhar Housing Finance Home Loan Eligibility Calculator to instantly assess home loan eligibility. Private Home Loan In Jaipur In 2021 Home Loans Aadhar Card Loan.

Source: indiamart.com

Source: indiamart.com

Documents Required for Aadhaar Card. Check Your Eligibility for Aadhar Housing Finance Home Loan The eligibility criteria is subject to change from one profession to another is as follows. The actual loan amount is determined after assessing the individuals requirement and his repayment capacity based on various factors like. Age Educational background Stability and Continuity of income Number of dependents in the Family. Bank Salaried Home Loan Nill 25years Aadhar Housing Finance Ltd Id 22658090455.

Source: ar.pinterest.com

Source: ar.pinterest.com

The actual loan amount is determined after assessing the individuals requirement and his repayment capacity based on various factors like. To know whether you qualify for an Aadhar Housing Finance home loan use the Home Loan Eligibility Calculator. Loan Amount You can apply for any amount starting from Rs 25000- to Rs 500000-. Loan Purpose You need to provide the purpose for taking loan for eg. Apply For Used Car Loans Online Bankbazaar Com Car Loans Aadhar Card Loan Interest Rates.

Source: in.pinterest.com

Source: in.pinterest.com

PERSONAL LOAN INTEREST RATES STARTING AT 1099. Salaried persons All salaried employees including 3 rd or 4 th grade employees in Private firms or Government departments such as police defence municipality and so on. The tenure however does not extend beyond the retirement age or 60 years 65 years in case of Self-Employed individuals whichever is earlier. A salaried applicant should have at least two years of work experience. Home Loans Under Pmay Scheme Home Loans Loan Finance.

Source: pinterest.com

Source: pinterest.com

Applicant should Have Aadhar Card on which heshe want to take loan. Searching For Aadhar Home Loan Eligibility Auction Com Home Loan Letter Of Recommendation For Mortgage Loan Lloyds Svr Mortgage Rates Loan On Home Mortgage Lic Of India Home Loan Lexington Mortgage Corporation Making Extra Payments To Mortgage Principal Macquarie Home Loans Contact Lloyds Mortgage Application Local Home Loan Lenders. You must be 21 years of age and below 55 years to apply for an instant personal loan. Home Loan for self. What Are The Key Advantages Of Home Equity Loan Home Equity Loan Home Equity Loan.

Source: pinterest.com

Source: pinterest.com

Here are a few more factors that are considered. The actual loan amount is determined after assessing the individuals requirement and his repayment capacity based on various factors like. Home Loan for self. Documents Required for Aadhaar Card. Personal Loan Available Personal Loans Personal Loans Online Instant Loans.

Source: axisbank.com

Source: axisbank.com

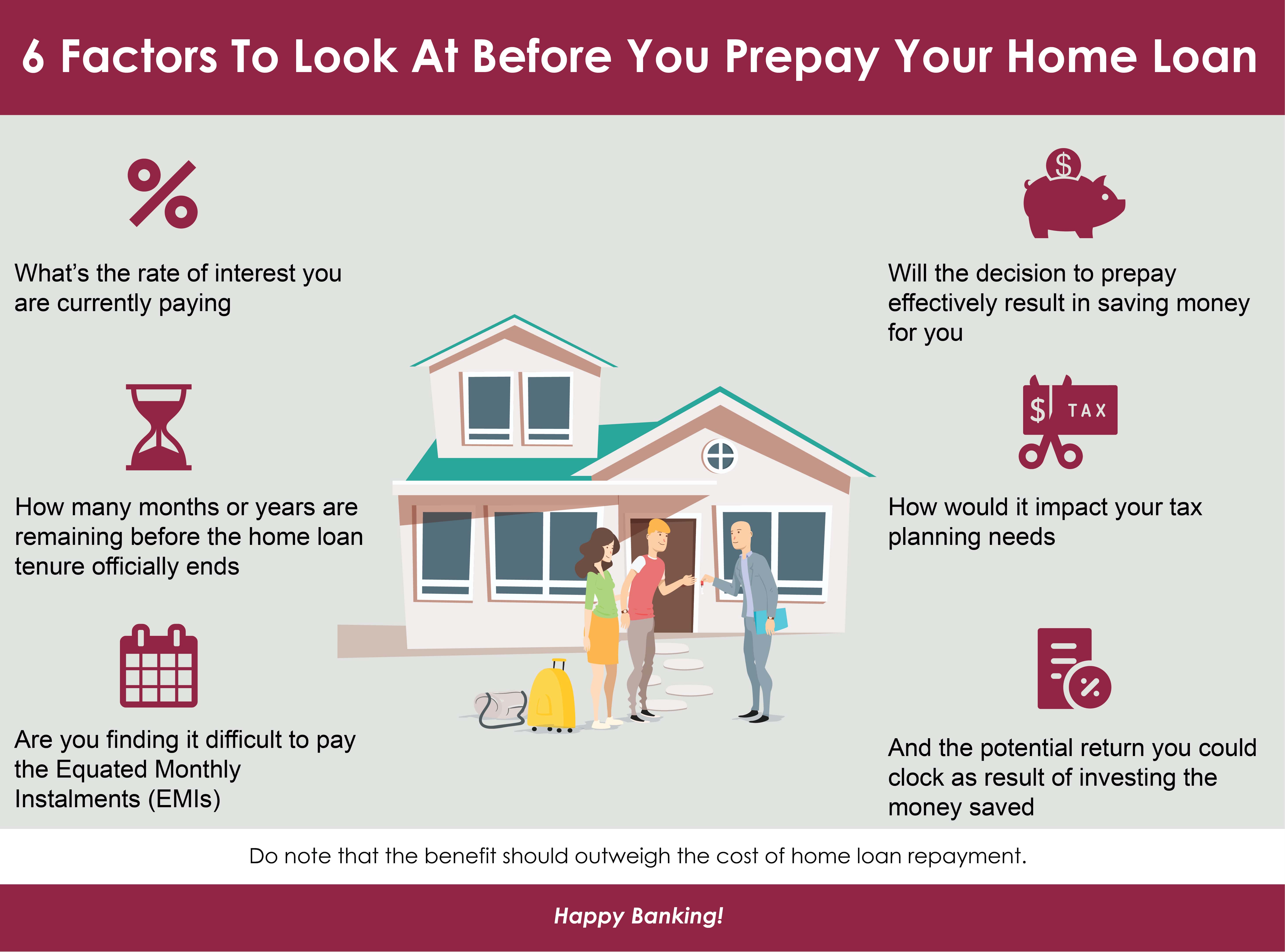

After assessing the requirements of the individual their repayment capacity and other factors the actual loan amount is decided. The minimum age of the applicant should be at least 24 years. To Get the benefit of this scheme Applicant should have above 18 Years. 15000 Document Required Duly filled application form with passport-sized photographs KYC documents. Home Loan Prepayment 6 Factors To Look At Before You Prepay Your Home Loan.